Last updated on September 4th, 2023 at 11:19 pm

Last Updated on September 4, 2023 by

Considering buying that second home in close proximity to the beach? Looking at beachfront properties, perhaps an attractive beachfront condo? As with the purchase of any property, there are things you should take a closer look at. Home buyers who are looking at beachfront property specifically condos and town homes need to do some homework. This article presents 21 things to consider before you sign an offer. You may have already purchased your primary house so you know some things to look for but buying beach properties and in particular condos and townhomes present other issues.

It’s best to start by describing the difference between a townhome and a condo. For purposes of this article, I will consider both as being the same but there are real differences such as the following:

| Feature | Condo | Townhouse |

|---|---|---|

| Ownership | Own the interior of the unit | Own the interior and exterior of the unit, as well as the land it sits on |

| Common areas | Owned by the condo association | Owned by the individual homeowners |

| Amenities | Often have more amenities, such as pools, gyms, and laundry facilities | May have fewer amenities, but may have a yard or patio |

| Privacy | Less privacy due to shared walls and common areas | More privacy due to fewer shared walls |

| HOA fees | Typically higher than townhouse HOA fees | Typically lower than condo HOA fees |

| Maintenance responsibility | Condo association is responsible for exterior maintenance and common areas | Homeowner is responsible for exterior maintenance and common areas |

Most beach areas offer condos rather than townhouses. The reason is space. Condos can be built as large towers as townhomes own the land the unit is built on. It is most likely that your target will be a condo with perhaps views of the ocean. You may be looking for a primary home a vacation home or perhaps a short-term rental. Regardless, this article covers most of the points you should consider before signing up for monthly payments.

21 things to consider

1. The location:

Do you want a scenic drive or warm weather, are you interested in water sports or just like ocean views? These and other things are part of your decision on the actual property you will buy. Are you set on a condo located on sandy beaches or will you be happy a block from the beach?

A waterfront home will cost more than a condo located a block or two from the beach but within walking distance. Many condos near the beach are located on a busy road, it’s just how things work. You have a beach, a row of condos, and a service or highway.

2. Views

Do you want an ocean-side house (condo/townhome) or a view of other buildings? The price of your unit will be determined by the view and height of the building. Beautiful views come at an additional cost vs. the units that face the street.

If living in close proximity to the beach is the real goal with ocean views a secondary consideration then buying at a lower price to live in the same area may be a better deal for you. Consider resales as well. Be sure not to overpay for a property without a view even if it is very nice inside.

Keep in mind that if you are buying a condo with vacant lots around it, one day they will not be vacant. How would that affect your view in the future?

3. The size of the condo

The price range will depend upon the number of bedrooms as well as the location of the building and proximity to the beach. You can buy a one-bedroom or even a studio condo but before you do, consider guests. Many retirees have found that they need more space, at least a two-bedroom unit to accommodate family members and friends.

Even three-bedroom condos may not be out of the question depending upon the size of your family. If this is a vacation home for your family perhaps the larger unit is best particularly if more than one buyer is sharing the cost. In some areas, it is harder to sell a one-bedroom or studio unit particularly if it is not facing the beach.

4. Condo Association (HOA)

What will you do with the condo? Is this for your use as a primary residence or will you use it with guests and perhaps want to rent it? Condo associations are created for the common good of the residents. The CCRs (conditions, covenants, and restrictions) are designed for a lifestyle. Some HOAs do not permit short-term rentals, this may be a problem if you decide later to rent it when you are not there. Some do not permit pets, what will you do with fluffy? It’s very important to read the CCRs before you make an offer.

You can ask your real estate agent about some items but you need to see the actual wording. Perhaps you agree that you do not want to live in a condo that is used for short-term rentals, good to find CCRs that respect that. If you have found a property that you like, check social media for comments about the HOA. Can you live with the restrictions? Do not decide to buy and expect the HOA to change their rules for you.

5. Special assessments

Some condo buildings come with special assessments. These assessments are required to maintain the property. A well-run property should not need special assessments because the HOA fees should have been assessed to take care of future issues. Unfortunately, many associations hire poor property managers who fail to plan for future accruals.

A building inspector will come by and require changes to the stairwell for example that will cost $50,000. The residents must pay for this as a special assessment. Sometimes the assessment is a one-time cash payment, sometimes it is paid over time. I bought a townhome one time and was not told that the association had voted to install new roofs as a special assessment. The sellers were aware of this but did not disclose it.

About six months after the purchase I was notified that I needed to come up with several thousand dollars. Yes, the law requires that sellers disclose this, and if they do not they are liable but it takes legal work to secure compensation. Ask the HOA if there are any current or planned special assessments.

6. Condo fees

Not all condo fees are bad. It’s important to break down what you will receive as part of your HOA fees. The best way of doing this is to make a list of the items included and estimate the value of each item. The following is an example of a breakdown and estimate:

- Common area maintenance: This includes the upkeep and repair of all common areas in the building, such as the lobby, hallways, elevators, and exterior.

- Utilities: This may include water, sewer, trash removal, and sometimes electricity and gas.

- Insurance: This covers the building’s liability insurance and property insurance.

- Reserve fund: This is a savings account that is used to pay for major repairs or renovations that may be needed in the future.

- Management fees: This covers the cost of hiring a property management company to oversee the day-to-day operations of the condo association.

- Amenities: If the condo building has amenities such as a pool, gym, or parking garage, these may also be included in the condo fees.

If you believe that the remaining amount of xxxx for tennis courts, swimming pool, and recreation room are worth that amount then the fees are reasonable. If you determine that the amount remaining after necessary items such as insurance, and maintenance costs is not reasonable then you should look at other properties with HOAs that charge a more justified monthly fee.

Don’t forget to ask the HOA about the fee structure. How is it determined? By square foot, number of bedrooms, etc. When was the last time the fees went up and by how much? Are fees scheduled to go up in the near future? When they do go up what is the typical amount?

7. Condo insurance

Often condo insurance for the exterior of the unit is included in the HOA fees. HOA fees rarely cover any internal part of the condo such as your personal items. If a water line were to break on the water heater, would the condo insurance pay for it?

You need to be insured for the gaps in the HOA coverage. Many HOAs cover flood insurance and wind and hail, usually the grounds and building. Before you sign the offer, get the details of who pays what for insurance. Beach homes need more insurance coverage than many other types of property. Wind and hail coverage is increasing, ask about future increases in HOA fees for this item.

8. Property taxes

You will be subject to property insurance for your condo. Local tax agencies often base their tax rate on real estate prices. They can use complicated formulas to determine your tax rate. Some have exemptions for seniors, disabled, or others. HOAs usually pay property taxes on the portion of the property used for swimming pools, tennis courts, etc. It’s important to determine if there are any taxes passed through the HOA to you.

9. Security

Some condos have a full-time security guard, and many have gated perimeters and or locked entrance doors or gates. One of my clients lives in a highrise condo with a full-time guard. Anyone not living there must sign in and will not be permitted on the elevator before the owner clears them. Most condos however use security entrances that include electronic entrance tokens.

If security is important to you, be sure to ask the HOA about security precautions that are already in place and ones that you can take. People using their beach condos as vacation homes should consider if they need a security system.

10. Noise level

Is the condo of your dreams, your new home located in a high-noise area? Are you ok with that? Many condos are located on busy streets that get quieter later in the evening. It is a good idea to drive by the area at different times of the day and night to determine the level of noise if that may bother you. If your prospective condo is located near bars or nightclubs with live music, and the noise bothers you, consider another location. On the other hand, having entertainment venues close by may be a benefit.

11. Hurricane risk

If you are buying a condo on the beach anywhere from South Texas all the way around the Gulf of Mexico to New York, you may be at risk of your property being subject to a hurricane. Unfortunately, that is life by the beach. Natural disasters should be considered at any property you may want to purchase. This includes buying a home in California where a fire, mudslide, or earthquake could occur.

Look at the frequency of tropical storms that hit the area you are interested in and what damage is caused. The best places are usually exposed to weather events at some time. If you want to live by beautiful beaches there are risks. Most beach towns experience a storm every few years and yet they continue to thrive. Highrise buildings seem to weather storms better than properties built on the ground.

Ask the HOA manager about damage sustained during the last hurricane. The housing market in beach areas across the board is usually very good even considering the possibility of a hurricane. The HOA should be insured against most losses. If there is a major hurricane that blows windows out, the HOA should have reserved funds for repairs.

12. Parking

The last thing people think of asking is about parking. Parking is however an important factor. Can you park under the building? Is there a separate parking structure? Do you park in an uncovered parking lot? Can you buy a parking space? These are great questions to answer. I bought a condo in Spain years ago and the builder offered the opportunity to buy parking spaces under the building.

This was the first for me, buying a parking space was strange. I did buy it and received a deed for a numbered parking space. All I had to do was use the remote to open the garage gate, drive in, and take the elevator to by third third-floor unit. The number of parking spaces is important.

You may get one space under the building with the opportunity to use open spaces in the parking area. What about your guests, where will they park?

13. Amenities

A good thing about buying a condo is the amenities that you will have use of. This is the part where that swimming pool, tennis courts, recreation room, and children’s play area will be weighed against the cost of that portion of your HOA fees not spent on insurance, etc. Will you use the amenities?

If you are buying a condo based upon that great swimming pool or hot tub and you don’t swim and you have no guests who swim then why buy in this location? Some people buy their condos based on the amenities. A few condos come with access to golf courses or similar amenities such as restaurants.

Will the cost of the amenities justify the HOA fee for them? Again, will you use the amenities or will you buy in a location with amenities for better resale opportunities? Important, Will amenities be open when you want to use them?

14. Condition of the beach condo

Will the initial costs of buying and rehabbing your condo make sense? If you are looking for a good return on your investment, there are things to consider. Is the condo ready to be lived in? Will you be required to update the kitchen, and bathrooms or paint? The price you pay should reflect the work you must do inside.

Real estate agents can help you on this topic by explaining the difference between the price for a move-in ready unit vs. a unit that requires work. If this is to be a rental property as well as your vacation home, you may want to improve it by changing the paint and appliances for example. The following is a list of items to investigate:

- Overall condition of the building. Take a look at the exterior of the building for any signs of wear and tear, such as peeling paint, cracks in the foundation, or missing roof tiles.

- Maintenance and repairs. Ask the seller or property manager about the building’s maintenance history. Are there any major repairs that need to be done? How often are the common areas cleaned and maintained?

- Condo fees. Condo fees cover the cost of maintaining the common areas and amenities of the building. Make sure you understand what is included in the fees and what, if anything, is additional.

- Reserve fund. The reserve fund is a pool of money that the condo association sets aside for future repairs and maintenance. Ask the seller or property manager how much money is in the reserve fund and how it is managed.

- Waterproofing. Check for any signs of water damage, such as mold, mildew, or peeling paint. This could be a sign of a more serious problem, such as a leaky roof or foundation.

- Pests. Look for any signs of pests, such as rodents, insects, or mold. These can cause damage to the building and make it difficult to live there.

- Security. Make sure the building has adequate security measures in place, such as a security system and controlled access.

- Amenities. If the building has amenities, such as a pool, gym, or parking, make sure they are well-maintained and in good condition.

You may think that since the unit is a condo, rehabbing it may be inexpensive. The most common changes that I see are people tearing out the kitchens and replacing them with bathrooms. New tile flooring and paint. The cost of these changes can be significant. Ask a contractor before you agree to buy it as is.

15. Condition of the building and complex

The section above about the special assessments comes in here as well. Has the condo building(s) and property been well maintained? Walk around, do you see deferred maintenance everywhere you look or does the property look to be well maintained? If you see cracks in stucco, bricks missing, roof issues, cracked sidewalks, or poor vegetation, you should ask the HOA about it.

Properties that are not well maintained are just pushing that work off to the future. At some point, there may be a special assessment to make the repairs. The HOA may tell you that the last storm did damage and they are awaiting an insurance payment. They may also tell you that they do not have funding to keep up the property. If the latter is the case, you may want to move on.

16. Resale value

What has been the resale value of properties in the area? This is easy to determine. Your real estate agent can give you lots of details, particularly for developments with many units. There are almost always some units for sale so there will be plenty of data available. Years ago when I first moved to the Mississippi Gulf Coast, I noticed that the price history on some of the condo towers was erratic.

As they were built, the prices rose very high, even higher than they were when I arrived. Then Hurricane Katrina came through and prices dropped. Within a year of Katrina, prices began to increase. At this time, prices are well above the original purchase prices. You may remember back in 2010 when the real estate market in many states collapsed condos in Florida were hard to give away.

They are now at all-time highs. Owing a coastal home is a dream for many and that dream keeps fueling demand and that affects property value. Not every property however will be a good buy. If the area has degraded and the building has not been well maintained, resale value will be at the lowest.

17. Rental potential

Most condos are prime vacation rental properties, particularly beach condos. There is a good reason why condos rent so well. They are near the beach, have easy access, and more often they are rented by couples who just want a big city getaway. Rental income can help offset the cost of your vacation rental property. Unless an investor buys a condo for cash, it will be difficult to earn enough to pay all of the operating costs and mortgage.

Over the past few years, the number of vacation rentals has increased significantly outpacing the number of potential renters. Even during high-demand times of the year, occupancy rates for a single property are down. Again, if you are trying to supplement your expenses, short-term rentals may be a good consideration. Generally but not always, local regulations and local laws control short-term vacation rentals.

Usually, condos are permitted to rent to short-term guests because of their zoning. It’s best to check with local authorities before you buy if this is an option for you.

18. Financial factors

You must decide if you can afford both your primary residence and your new condo at the same time. You may need a property manager to look after your property when you are gone and to manage any short-term rentals that you may have. While the cost of the property manager will be paid by the guests, there may be fees charged in months when there are no guests.

These fees should be minor but when added to electricity, water, sewer, trash, internet, and HOA fees months without guests should be factored into your budget. As I have mentioned above, most properties purchased with a mortgage will not earn enough to support themselves so be prepared to cover all costs if you decide to buy a vacation home. Mortgage lenders charge a higher mortgage interest rate for second homes so factor this in.

19. Maintenance

Even condos require some maintenance. While the HOA should be maintaining the exterior, you may be responsible for painting your entrance door replacing your water heater, and yearly AC maintenance. Things wear out over time and property located near salt water tends to deteriorate faster than property away from the beach.

Some metal items such as porch lights will begin to corrode and will require cleaning or replacement. Living in a beach condo means exposure to corrosive sea air. This means constant attention to metal objects. The unit may need a fresh coat of paint every few years. Sometimes a garbage disposal will require replacement or a dishwasher will leak under the sink. Plan your budget to include funds to keep the property well-maintained.

20. Emotional factors

Are you ready for more responsibility? Many people have dreamed of owning a condo by the beach because they vacation in the area year after year. More often buying a condo by the beach is an emotional decision. For others its investment property. Be sure you are buying the property for the right reason and that you can afford it.

You may love the idea of owning a condo but it will come with responsibilities such as payments and upkeep. Often I speak with people who are on vacation in my area and start thinking about coming back for another visit. After they leave, they decide it would be nice to own a property on the beach.

That’s great if you really like the area. There is nothing wrong with buying based on emotion, that’s okay. Just don’t forget the other emotions as well such as stress at making that payment.

21. The search

You need to work with a real estate agent particularly if you live outside of the area you are interested in. Your agent will help you through the search and buying process for your beach condo. With the internet, you can search for a condo but what you will not usually know about is the building and HOA. Real estate agents in beach areas know about the building.

For example, they will tell you that building X is full of renters when you don’t want to rent yours. Building Y has an underfunded HOA that will soon be looking for money to make repairs and that would be you if you buy. Building Z suffered during Hurricane Z and may again if another hurricane comes around. Perhaps you have found a really inexpensive condo so you ask your agent to give you some insight.

Where is the building located? Near a busy and noisy intersection. They know the “lay of the land” something that sellers will not discuss in their Zillow listings. Real estate agents also have access to information on multiple listings that is not exposed to the public. It’s best to work with a professional to find that perfect vacation condo on or near the beach.

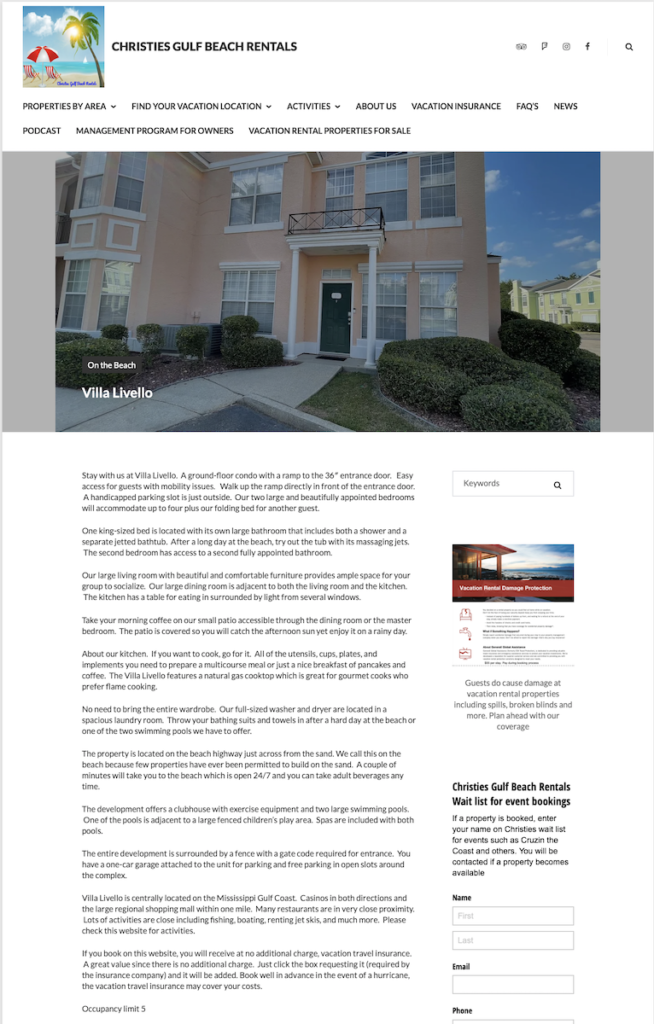

I recommend that you stay in a vacation rental property when you are in the area looking. After all, you may be buying the unit next door. If you are looking on the Mississippi Gulf Coast, try ChristiesGulfBeach Rentals.com

Things to do before you meet a real estate agent

These 21 items will hopefully help you in your search for the right property for you. Before you start looking, assess your financial situation. If you intend to finance, be sure that you have checked your credit and fix any issues that will reduce your score. Is your debt-to-income ratio good?

With higher interest rates, you can help yourself by ensuring you have a higher credit score and low debt-to-income ratio. If you get to the point that you are serious and will actually buy a condo, obtain pre-approval from a mortgage broker before you make contact with the real estate agent. Very few sellers will allow you access to their property without seeing a copy of your pre-approval letter.

If this is your first property or you have not purchased one for a while, I recommend that you check out a few articles on this site that were written for Gen Xers but apply to everyone. These articles will help you with understanding credit and the purchase process. Click below, they also have calculators to help determine the debt-to-income ratio for example.

Millennials are buying homes near the beach: Buy yours now

Millennials: How to find your first house in 2023

Millennial Financial Resource Referral Page

LOGAN-ANDERSON GULF COASTAL REALTORS

If you like this article and are considering a move to the beach, take a look at the beautiful beach-close properties available through Logan-Anderson Gulf Coastal Realtors