Last updated on April 14th, 2023 at 11:39 pm

Last Updated on April 14, 2023 by

Your monthly cost to buy a house can be lower than the cost to rent. With sufficient Social Security income and good credit, you may qualify to buy a house. Yes, you can buy a house on fixed income Social Security alone in 2023, and here is how.

Start with good credit. You will need a minimum credit score in the high 600’s but the better credit gets better interest rates given to scores of over 720. Next, are your ratios. This is your debt-to-income ratio. Your total debt reported to credit agencies plus your mortgage, insurance, and taxes can not generally exceed 45% of your gross income.

Gross income would be your social security income. Let’s get into an example of how a couple collecting only Social Security can afford to buy a home assuming that the above lines up. Mortgage lenders are required to treat Social Security retirees just like everyone else. If you have good credit, and your Social Security income is sufficient they will finance you. This is all part of the equal credit opportunity act.

Sample Social Security Income

This assumes that a married couple at full retirement age is both drawing Social Security retirement benefits. One individual receives $1,450 per month and the other receives $2,500 per month. The combined income is $3,900 per month. This would be the gross monthly income. Any income from other sources such as dividends, interest, etc. would be added to your Social Security payments.

With an income of $3,900 per month, you can spend as much as $1,700 per month on your mortgage payment and debt payments. Assuming that you have only a $100 per month credit card payment, you can spend up to about $1,600 on housing costs.

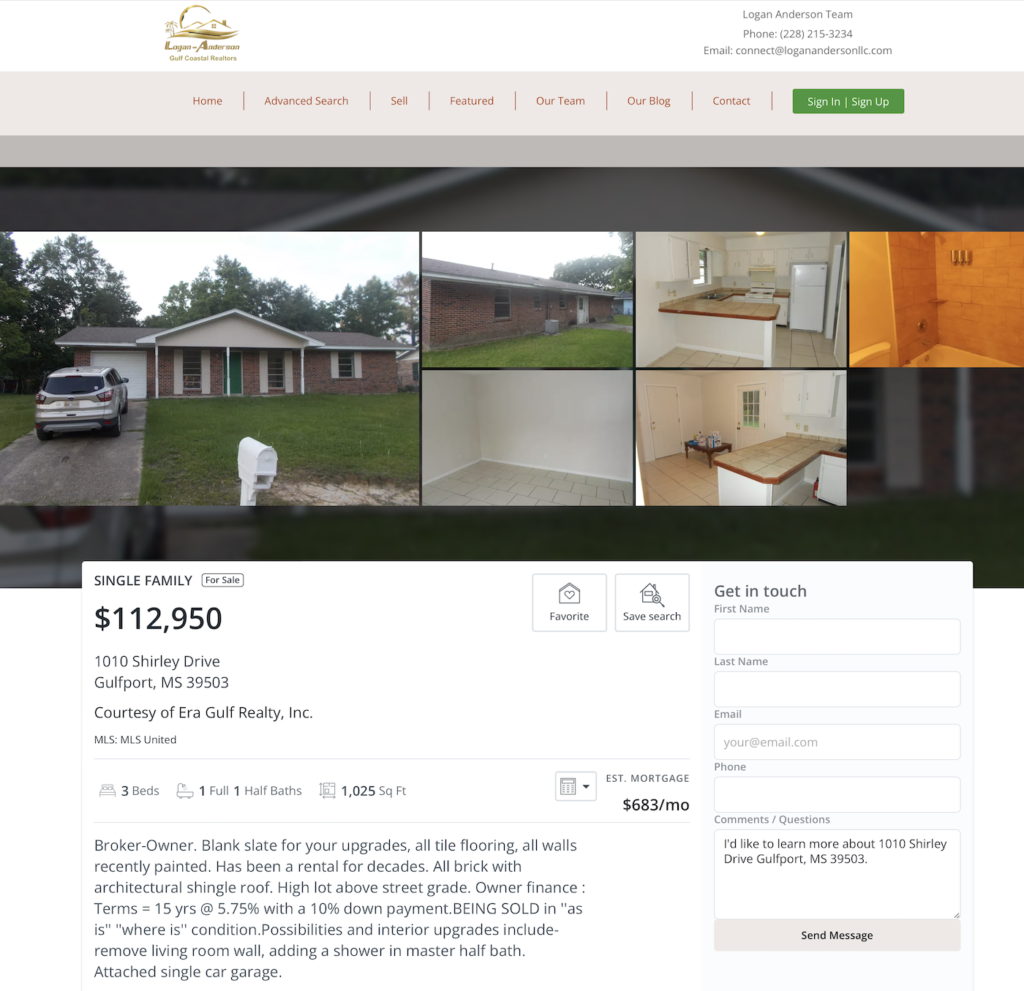

Let’s look at a sample mortgage payment for a house that can be purchased for $112,950. Another assumption made here is that you qualify for a USDA home loan that permits 100% financing.

With an income of $3,900 per month, you can spend as much as $1,700 per month on your mortgage payment and debt payments. Assuming that you have only a $100 per month credit card payment, you can spend up to about $1,600 on housing costs.

Let’s look at a sample mortgage payment for a house that can be purchased for $112,950. Another assumption made here is that you qualify for a USDA home loan that permits 100% financing.

Other loan options for Social Security buyers

You may qualify for VA loans, FHA loans, or even conventional loans. The VA mortgage loan is a good way to go if you have the funds to cover the closing costs. The FHA may be a good alternative as well if you have trouble with your rations.

Often people who would otherwise qualify for a USDA loan have issues with their ratios. They may have credit card debt, a car payment, etc. which prevents the ratios to line up. Opting for an FHA loan lowers the monthly payment because of the down payment. This may bring the ratios back in line.

Your loan broker can work with you to select the best options for your circumstances. We can recommend a loan broker you can work with. FYI, your loan broker can often help you increase your credit score by recommending things you can do e.g. pay off a credit card.

About that credit report

As mentioned above, your loan broker can help you by making recommendations to help improve your score. Even when your score is a qualifier, if it goes up, you may qualify for a lower interest rate. Start the buying process several months ahead of applying.

Read this article on our site. It explains the need to start well before you make a written application. Repairing credit takes time and it’s good to see what you are up against before you start making plans. After all, you now know that you can buy a house on Social Security alone.

Calculating the house payment

Using the ratio formula above,

With zero down the amount financed will be $112,950 for that three-bedroom, one-and-one-half-bathroom house located on the Mississippi Gulf Coast. The location is important, most areas of the country are priced well out of reach of the median income.

Affordable housing for those on Social Security alone is difficult to find except on the Mississippi Gulf Coast. That new home may be entirely unaffordable with the annual income earned by typical Social Security recipients.

The house we are using for example is very nice and not far from the beach. The property taxes and insurance were estimated and included in the estimated monthly mortgage payment of $963.91. As you can see from above, you would qualify for up to $1,600. At this point, you can buy more houses or have more money left for spending on medical or other costs.

Tax benefits

Two more key points about this house and where it is located. As your primary residence, you are entitled to a senior property tax exemption when you reach the age of 65. Your property taxes will be sharply reduced with this exemption. This is one way your monthly social security income can make the mortgage payment.

The other key point is that the state of Mississippi charges zero state taxes on Social Security or any other withdrawals from retirement accounts for those over 59.5 years.

Compare to rent

Rent will run about $1,000 per month on the Mississippi Gulf Coast. Some properties will cost less and those that can cost considerably more. Note that the rent payment is about the same as the cost to buy a house. Few areas in the country offer the option to buy a house or rent a house for the same price. It’s a good idea to take a good look at rental properties and houses to compare where you want to live.

Yes, you can buy a house for less than you may pay for rent when you buy a house on Social Security alone in 2022.

If Social Security is your only source of income you may need to move out of that urban development to the Mississippi Gulf Coast. The good news is that should you be physically able to work, there are many jobs available to provide a regular income to supplement your Social Security benefits.

We can help you

All of this is leading up to the fact that Logan & Anderson, Gulf Coastal Realtors can help you find that perfect property. We know the mortgage programs and can recommend lenders who can work with you. We can help you ahead of completing that mortgage application. If you have never been to the Mississippi Gulf Coast, we can help you understand the options available to you based on your limited income.

I recommend that you read this article about Retiring on the beach on Social Security in 2022. This extensive article provides more in-depth information about how you can afford to live on the amount of income you earn from Social Security alone.

It’s time you create a plan for your retirement years and we are here to help. This article and many at this site will help guide you along the way.

Logan&Anderson, Gulf Coastal Realtors

Visit our website at LoganAndersonllc.com and check out the movable properties in our area. Perhaps you are not ready to make a move now or you are looking for a house that is not yet available. Let us know and we will be sure that you are notified when a home comes up with your specifications.

Making a home purchase is an important decision. Before you make it, allow us to give you the benefit of our experience. Not only with the house but with the area. If you are a veteran, let me know. I am one as well. There are programs and discounts available for veterans. As mentioned above, that VA loan is a great place to start buying a house on Social Security alone in 2022.

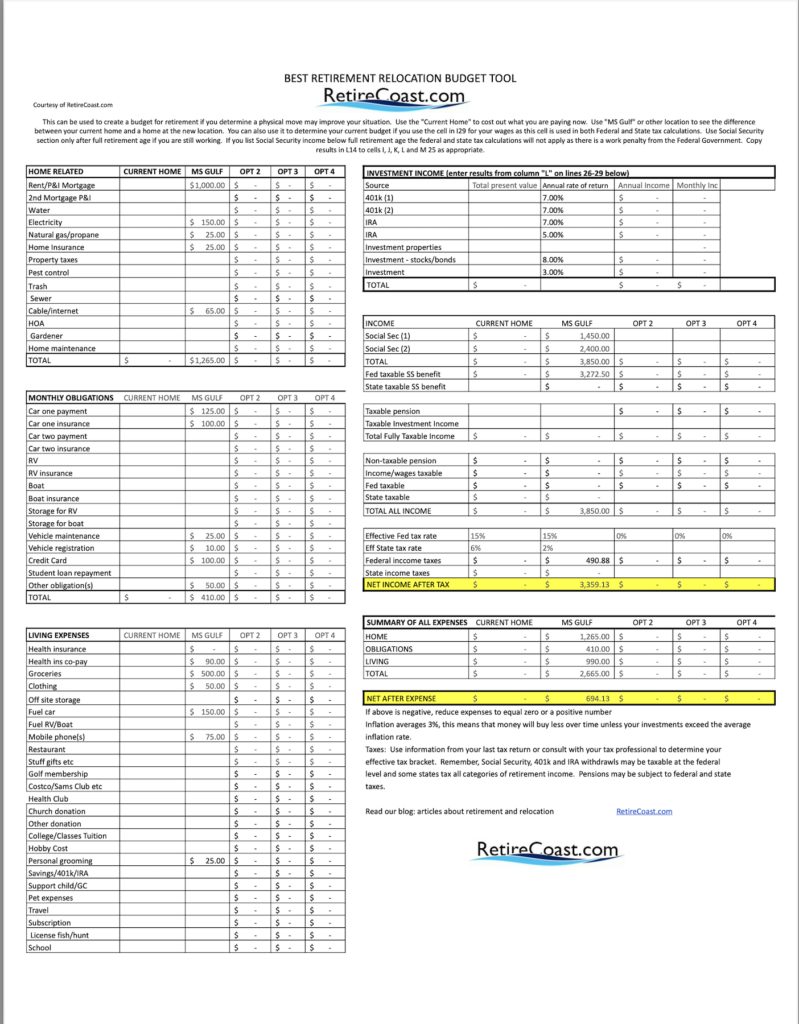

Create your budget

The Best Retirement Relocation Budget Tool is an excellent tool to help you determine how much house you can afford. We strongly recommend you use this free tool provided by Retirecoast.Com to see how you spend money. After loading the tool, you will know what you are “comfortable” buying rather than what you can qualify for. Often because you can make a higher payment does not mean that you should. This tool will help you determine the best options.

Mississippi Gulf Coast

You probably came to this article based on the title. After reading the above you discover that our examples are based on the Mississippi Gulf Coast. Knowing that your only income is Social Security, I believe you can connect the dots. There are not many choices for people who are living on Social Security alone. You may have been living in a nice area in a big metro but realize after leaving your career, you can’t afford to stay.

Perhaps you were not able to save for a variety of reasons or were stuck with debts e.g. college. Regardless of how you arrived at your situation living on Social Security alone, you can make a nice life on the Mississippi Gulf Coast. This is a great place with lots to do. Many things are at zero cost.

There is no need to stay in your house, get out and walk on the beach. Attend an event. If you would like to know more about the Mississippi Gulf Coast, read blog articles on our site and at RetireCoast.Com.

Call or message us at Logan & Anderson LLC.com, we can tell you anything you want to know about the area. Did I forget to tell you about the very large number of retirees in this area? You will not have trouble creating a network of friends on your own. A good option is to go through the budget, look at our website and contact us. Doing some research is always a great place to start.

Buy a house on Social Security alone in 2022 – Read our references below:

References

RetireCoast.com is a great place to read about the area and retirement.

LoganAndersonLLC.com is another great place to learn about the area and see houses for sale and rent

Why I decided to retire in Ocean Springs, Mississippi an article about the area

Why you need to retire on the Mississippi Gulf Coast yet another article about the area

22 Things to do on the Mississippi Gulf Coast go here to see what the Gulf Coast has to offer

Serious about buying a home? Getting pre-qualified or losing out is a good place to start understanding credit

Retire by the beach on Social Security in 2022