Last updated on April 26th, 2025 at 03:01 pm

Last Updated on April 26, 2025 by

Stop, do not buy that short-term rental property before you look deep into the numbers. I own and manage many properties and have seen the market drop significantly since the highs of 2020 and 2021. Some sellers are offering documentation proving high gross income. Great, that was then, this is now. Don’t buy based on those old and out-of-date numbers. They may give you an idea of potential, but it’s not likely you would see those numbers anytime soon. Want to know why the short-term rental market is underperforming now in 2025? Then read this article.

Vacation Rentals in Beach Areas are coming on the market in large numbers

For several years inventory has been low. vacation rental owners are now selling at a faster pace, fully furnished properties and prices are falling as of august 2024

Alert to buyers:

- Too many vacation rentals in some market areas – Giant growth in the last four years

- Rental prices are dropping in most rental markets – Experienced owners think the price is the issue

- Investors are not breaking even – Many have high debt and operating costs

- Properties are listed with data showing out-of-date income, virtually impossible to duplicate in the post-COVID world

- Could be on the verge of foreclosure and bankruptcy filings on vacation rental properties.

- Fire sales can cascade, reducing property value

You want to be or are a real estate investor. You want to own profitable short-term or even long-term rental properties. Great. The problem that I have seen in the market is that current vacation rental properties are posted on the Multiple Listing Service or even Zillow and Realtor, who copy from the MLS, showing old data. Some of these listings insinuate that you, too, can earn a great bottom line and that their property is a good deal.

No one likes to admit they made a mistake

The vacation rental business is gong through a transition, its hard to tell where the business model will come out in the years ahead, planning and working the plan will eventually right the ship.

Ask yourself, if you are looking at listings for existing short-term rental properties, why are they selling? Why are so many on the market? The main reason, I believe, is that the buyers who purchased in 2020 and later thought they would make a bundle. If they bought early enough before the big spike in investment property prices, then cash flow would be good.

These very early buyers may have had an investment strategy of buy now, hold for a bit, experience high rental income, and sell. Short-term rental properties are now everywhere in areas where people tend to vacation.

Short-Term Occupancy Rates (National)

| Year | Occupancy Rate |

|---|---|

| 2020 | 70% |

| 2021 | 75% |

| 2022 | 65% |

| 2023 | 60% |

| 2024 (est) | 58% |

Source: Airbnb, VRBO, STR, and Datarade quarterly and annual reports

The chart above indicates that short-term rental occupancy rates have dropped since 2020. The forecast for 2024 is a continuing softness from the high COVID year of 2021. This national data I believe, mirrors all but a few extremely unique areas. Some areas have, for example, military members who spend a few months during training. In areas with lots of workers who are completing a large project, occupancy will be high.

What this chart tells us is that there is an economy that is getting used to high rates of inflation and life after COVID-19. People seem to be working on getting back to a new normal in all of their life plans, including vacations. Remember, cruise ships and travel abroad were almost non-existent in COVID times; now there are more options.

Too many short-term rental properties in some markets

Frankly, there are far too many short-term rental properties for some local markets. The flood of vacation rentals during the past few years has caused rental prices to drop and the typical occupancy rate to drop. Your real estate agent needs to get into the data about the area.

Some are good with investor properties, some are not so good. Find one who knows their business and is prepared to share information about the rental market before you buy. Ask your agent for a good property manager who knows the market and can help you with good information.

If for example, you called Brian, Christies Gulf Beach Rentals property manager, he can quickly tell you the trends on the Mississippi Gulf Coast. The same is true if you are buying property elsewhere. Most real estate agents have general information, but you need good, solid, fact-based data. Start by making a deal with the property management company that you will use their services if they help you and your agent locate the best property for what you want to accomplish.

It’s probably not the property manager’s fault

Desperate people are bouncing from one property manager to another, thinking that it’s the fault of the property manager that their property is not renting. Stop driving yourself crazy. If you are using a good local property manager, they are probably doing all they can to attract guests. I agree that internet management companies with no local footprint try to hire a cleaner without management experience who can not do as well as a local manager. Brian Logan, property manager for Christies Gulf Beach Rentals agrees, it’s time to be smart about the market.

Brian says that Christies will not accept everyone who contacts them. During the interview, if it seems the owner has been moving through managers, he may reject them. Another thing that Brian mentioned is that it’s important to contact a local property manager before you buy your vacation rental, and if you have already bought it, don’t try to set it up without the input of the local property manager.

Investors often buy the wrong door locks, jump into contracts for alarm systems, and buy things that are not necessary and can hinder the best performance of a vacation rental property in that area.

Mississippi Gulf Coast Vacation Rentals listed on Airbnb

| City | Number of properties | Average price per night | Source | Date |

|---|---|---|---|---|

| Ocean Springs | 1,088 | $150 | Airbnb | March 8, 2023 |

| Gulfport | 1,243 | $125 | Airbnb | March 8, 2023 |

| Biloxi | 1,150 | $130 | Airbnb | March 8, 2023 |

| Long Beach | 607 | $100 | Airbnb | March 8, 2023 |

| Bay St. Louis | 490 | $110 | Airbnb | March 8, 2023 |

| Waveland | 384 | $105 | Airbnb | March 8, 2023 |

| Pass Christian | 306 | $115 | Airbnb | March 8, 2023 |

| Gautier | 235 | $95 | Airbnb | March 8, 2023 |

| Pascagoula | 198 | $90 | Airbnb | March 8, 2023 |

| D’Iberville | 242 | $100 | Airbnb | March 8, 2023 |

New investors need to research before they buy

New investors should understand what they are about to do. We are recommending at this time (early 2024) that investment strategies change for short-term rentals. A good investment means either paying cash or obtaining a loan when you know that this is also your “haven” or place where you will be visiting often.

If you are obtaining a loan, you should understand that it is extremely unlikely with recent interest rate hikes you will be able to earn a profit from your vacation rental as a stand-alone business. Even with all of the benefits that come from investing in rental properties, including depreciation, appreciation, equity, and rental income, the market is not there.

I am recommending to my buyer clients that they consider, at least for now, buying and doing a long-term lease (when the property will be financed) until we see improvement in the short-term market. Many short-term rentals are on the market on the Mississippi Gulf Coast.

These fully furnished properties are ready to hit the market but with financing, they may not be profitable. If you intend to use the property as mentioned above for your real second home, future primary residence, or to pick up some income along the way, go for it.

Gross revenue for vacation rentals (National)

| Year | Number of Properties |

|---|---|

| 2018 | 1 million |

| 2019 | 1.5 million |

| 2020 | 2 million |

| 2021 | 2.5 million |

| 2022 | 3 million |

| 2023 | 3.5 million |

| 2024 | 4 million |

Source: Airbnb, VRBO, STR, and Datarade quarterly and annual reports

From 1 million in 2018 to 4 million in 2024. That’s a vast difference. Is there any wonder why fewer guests frequent a property? Even if the number of people traveling to a vacation rental was not lower than in 2020, their options are greater and with the falling price, their cost is down as well.

All of the things are lined up for guests to benefit from lots of choices, including making last-minute reservations, paying less, and having greater choices. This is a great time for guests, far different from a few years ago when everything was fully booked at times during the year.

Buy a current vacation rental at a good price

The best deal now is to buy a current vacation rental that is fully furnished and well taken care of. Check their ratings on ABB and VRBO. You want a 5-star or at least a high 4-star rating. This means that everything is working well. The ratings will not transfer to you, but you know that the property is kept in good condition.

You will be making an offer, and the seller knows that they can not gain any value from their $20k in furnishings. Appraisals do not take into consideration income from rentals or furnishings. If you were trying to buy this as a business, the income approach appraisal would note the current market conditions.

A good option is to have the seller cover all of the closing costs if that is permitted. Your real estate agent can tell you what they paid for the property. Remember the term “motivation”. You want to buy a property where the seller is desperate to get out. They have been digging into their employment income or savings to pay the mortgage on the property. They want out.

Properties bought before 2021 may have equity

Most are sitting on some good equity if they buy in early. e.g. before 2021. If you can make a cash offer, you may be able to negotiate a great price, even better. Given the seller’s financial situation, you could buy it for what they paid for it. This leaves the seller eating the cost of the furnishings. Remember, they made all that money, so they will probably come out even.

Just because you live in a high-cost state where a beachfront house would cost millions of dollars, do not let prices in your target area catch you off guard. Don’t just buy it because it’s “cheap”. The good news is that you are involved in real estate investing when the stock market is trashed. Ok, you see a house for $300,000 that you “know” would be a good vacation rental.

It might be, but will the purchase price permit you to make a profit? How about all of the other costs? Don’t let me discourage you at this point, I mentioned that I am a real estate broker so I like to work with investors. I want my investors to walk away with a “deal of a lifetime”.

Example of the house purchased under market

Here is a good example of a property on the Mississippi Gulf Coast that I sold to a client to convert to an Airbnb rental. This client liked the idea of tax-loss harvesting and long-term capital gains. Yes, he wanted it to come close to breaking even or possibly becoming profitable. He paid $165,000 for this 3-bedroom 2-bathroom house. He put about $30,000 into the house for a new roof, repairs, and furnishings. His total investment was $195,000.

The property is worth more than $275,000. Roughly a 32% (after sales costs) profit in less than one year. I have not even tried to put a value on the property as a vacation rental. In this type of case, should he decides to sell, adding information about the fact that it has been a vacation rental property and comes with all of the furnishings would be a selling point.

He bought his property just as prices started to drop, so close to the top of the market. This is proof that you can buy at any time in any market; if you get a good deal, it will work. The best chance of success is working with a great real estate agent who understands not only the market but also learns enough about the seller to recommend the best offer. Let me go further into this deal.

Three offers were rejected

I found that at least three offers were presented to the seller, who rejected each. The sticking point was the condition of the roof. The seller had no funds to repair the roof, even though he agreed to reduce his selling price to compensate for the cost of the roof. The problem is that the buyers were financing, and the roof condition prohibited traditional financing. The owner was stuck.

I made an offer on behalf of my client, knowing the circumstances, and it was $55,000 below his asking price. I told him that the only condition was a termite report. My client used a great contractor who inspected the house because he was promised the repair work. It was in the contractor’s interest to find everything he could to fix it.

We went back and forth with counteroffers. I called the selling agent and told her that my buyer was a medical professional with a high net worth and was a long-time investor. His credit was approved (I sent the lender a letter). I told her to call the lender and speak about the possibility of closing the loan. She spoke with the lender and was able to tell the seller that this was a solid deal that would go through. His house was on the market for nine months, and he needed the money.

The client bought the right

He signed the contract and the deal closed. My client bought the property for $55,000 below the market. The appraisal came in much higher. This was an investor loan, and the lender had no concerns about the roof. Of course, the roof was replaced after closing, and all cosmetic repairs were completed.

To come back to my point about buying “right”, this is critical if you are an investor and do not want to fall into the short-term rental trap (using two years ago’s income). There are deals out there and more to come as the market settles into a new reality of too many vacation rentals and too few guests.

Another trend that seems to be developing is that many guests are staying for just a few days, not an entire week. This past summer, instead of having week-long occupants reserved who paid the previous January, they waited until two or three weeks before and reserved. Lots of property managers and owners have reduced their prime season minimum stays from five days to three, and even some have taken restrictions out altogether. The profit margin has been hit hard in 2023.

A bit of good news is that, as of this writing in January 2024, it seems that there is some positive movement in the market, but not for all properties. Vacation rentals near the beach, those with unique qualities, and some that accommodate more people are getting booked more frequently.

Examples of properties that are recovering in 2024

A historic property that is offered by Christies Gulf Beach Rentals and is located on the beach is being booked more frequently now and in advance. Three things that put this property in demand. Its character as a historic house, it can accommodate up to 10 persons, and it is across the street from the beach.

Another property is located in Ocean Springs a tourist mecca that gets high magazine ratings. Ocean Springs has many events all year, and it seems almost every event brings guests to the cottage offered by Christies, which is within walking distance from the downtown entertainment area. Three reasons this property gets bookings now. It’s located in a popular town, close to the beach, within walking distance of things to do.

Another property is somewhat further from the beach, about 1/2 mile inland, but it is located on 3 acres. It accommodates 10. The key reason this property is often requested is that its large yard and outdoor entertainment amenities are great for family gatherings. A large game room contains a pool table, a dart board, a 70″ TV, and more. The conclusion is that it’s close to the beach, accommodates a large group, and features lots of inside and outside entertainment opportunities.

A property located a few miles from the beach with a swimming pool is very active. This is a very nice three-bedroom house on a secluded lot. The house is typical of a well-set-up vacation rental, but it’s not the house itself that attracts guests. It’s a private swimming pool. Condos with swimming pools do attract guests, but many larger groups, e.g., 6-12, prefer a setting with a private pool and will drive a few miles from the beach to get there.

Your property must stand out in this competitive market

If you are buying a condo, consider that there will be others in the development that will appear to be similar, e.g., close to the beach etc. If you are buying a house, it should offer amenities that condos and other houses do not. A swimming pool for example, or a very large yard with toys. Location is also important. While I am writing about beach areas here, if you have a property near a lake, it should be on the lake.

This is not the time to buy just any property. Consider the neighborhood. What will guests see when driving into the area? You may be considering buying a “flip” that looks great but the neighbor has the last three washing machines they bought sitting in the driveway. Your property should be exceptional in both curb appeal, location, and amenities. Buying small soaps will not do the job in this competitive environment.

Many short-term rental investors with mortgages

I suggest that many short-term rental investors with a mortgage are barely keeping up with their payments. This fall and winter when things slow down for beach areas, many owners will have hard decisions to make. They will need good investment advice on how to manage the shortages.

Recently, a new property management client discussed the possibility of putting her property on the market. She had just closed on it, and it was partially furnished. I suggested that she put it on the long-term rental market for now until we find out what is going on with pricing. She agreed, and we rented it the next day for more than her monthly operating costs.

In my opinion, she is making as much money if not more, leaving it on the long-term market. As short-term rates continue to fall, she will have done increasingly better with the long-term strategy.

With all that I have said above, you may be confused or at least disappointed about your potential passive income stream plans being dashed. This is not what I intended. I want you to experience high returns from your investment. Since you can not control the prices that competitors choose to offer their properties for rent, you have to focus on the cost side of things.

Don’t jump on a property because it looks cheap compared to X

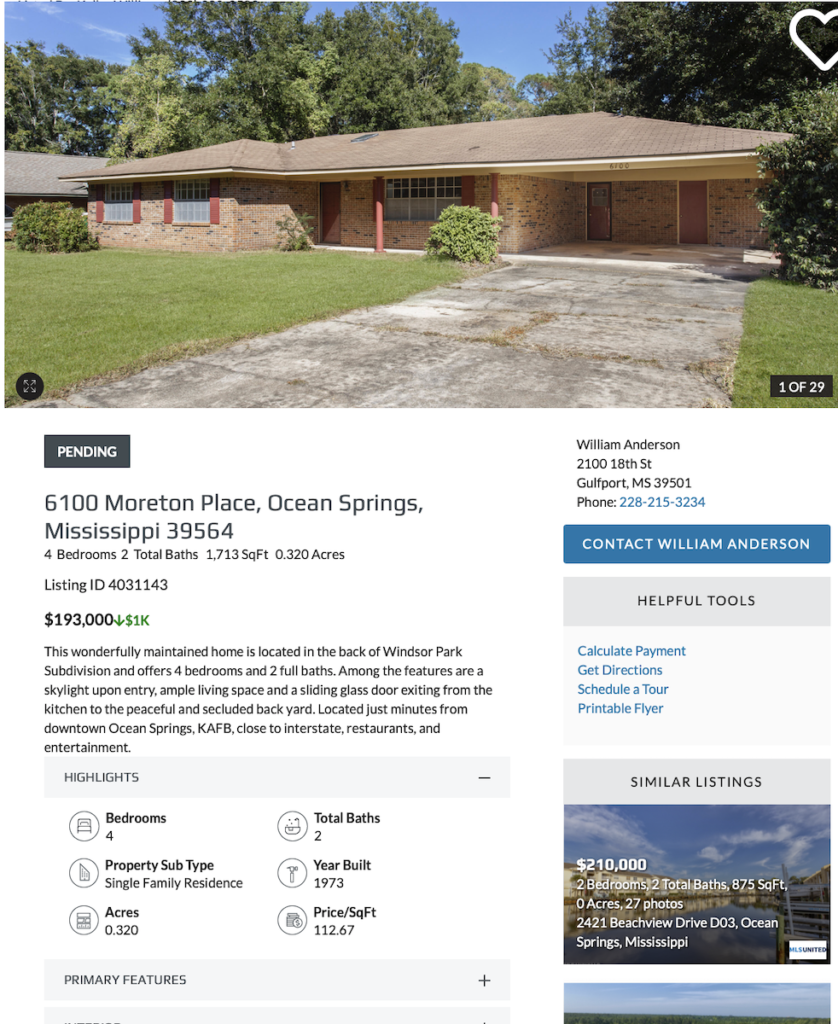

This includes what you pay for the property, insurance, taxes, and operating costs. Getting back to what I mentioned, you must get a real deal when you buy your property. Don’t jump at a property on the Mississippi Gulf Coast because it will cost $193,000, and a comparable one in Southern California would cost $850,000. Just because the price on the Mississippi Gulf Coast is lower does not make it a bargain.

The house above is a good example, it is listed as pending in an area where it could become a vacation rental. I am not commenting on the price except to say that just because it is listed for about 1/4th the cost of a property in Orange County, CA, does not mean that it is priced right for the Mississippi Gulf Coast market. If I were your agent, I would discuss value compared to other properties in the area that may be better suited for your purpose. Or whether this property is priced well or not.

Also, don’t get fixated on appreciation as a reason to lose current income. It depends upon where you buy and how much appreciation you can expect. I was an investor in Las Vegas and Phoenix for years when prices were extremely low compared to California and most of the country.

Appreciation was phenomenal. I lost money on some rent but made it up in appreciation. That may have been the case in other areas during COVID, but that ship has, as they say, sailed. Appreciation for most homes in most parts of the country is about 3-4% per year in a normal year.

You may take many years to recover with appreciation alone

If you are losing big on current income, you may take many years to recover that investment with appreciation. Another example. I own a townhome near the beach. The empty lots across the small street were inviting so a builder created two almost alike properties. These houses sold for $599,000 each. Considering they had a beach view and were a two-minute walk to the beach was impressive to the buyers.

They were sold at the height of the recent COVID run-up in property prices. The buyer bought them for use as a short-term rental. A very big mistake. It was impossible to break even, let alone make a profit. Someone told the buyers or they miscalculated that they could earn about 3x of what other similar properties were earning. Unfortunately, one just came to the market for the same price as it was originally sold for.

No doubt if it was financed, it was hemorrhaging money. Now, the selling costs of at least $36,000 plus furnishings of about $25,000 are a total loss. The buyer will walk away with a loss of more than $61,000. As a long-time investor, I knew as soon as the house broke ground when I was told they wanted to rent it on the VRBO market that it would be a loser.

I ran the numbers, and it was a clear loser

It was clear as day. I ran the numbers through my analytical system, and the property was a clear loser. I wondered if this was another out-of-the-area buyer who was enamored by the “cheap” price of a brand-new house steps from the beach.

If this property had been purchased as a primary residence, that thought would hold. At $599,000, it is an incredible bargain compared to any other beachfront area in the country.

Where do you go from here?

I suggest that you consider the following points before you take any action or decide to take no action:

- Can you afford to keep the property if income does not improve by X date?

- What are your options: 1. sell, 2. rent long term, 3. ride it out

- Evaluate your market, investigate other properties and prices

- Turn over to a property manager with more resources to advertise and promote

- Consider paying off the loan from savings. Evaluate the current return on savings vs. the lower rental income from the vacation rental. It may make sense to self-finance.

- Sell your primary house and move into the vacation house

- Renegotiate the loan with your lender

The above are just a few things you can do if you find your income stream not keeping up with your expenses. There are more things you can do. Read this article. Consult Christies Gulf Beach Rentals if your property is located on the Mississippi Gulf Coast; they may be able to help.

Buy as a true vacation home with some income

Buying a vacation property is still a great option for those who can afford it. Before you run the numbers on potential income, make a safe assumption: “zero income from rentals”. This means you can afford the property either by paying cash or financing. Without a dollar of rental income, you cannot afford the property.

Now that you know you can afford your beach-front property for vacations, find a good property manager to watch over the property for you. There will be a minimum price for months with zero rental income, but it’s worth it to have someone looking after your interests while you are living three states away.

The property manager will be able to place people on your property periodically, which works around your schedule. Christies Gulf Beach Rentals on the Mississippi Gulf Coast offers owners a client portal where they can book their own time at their place. Most of Christies clients just want to earn enough to cover taxes and utilities. More often, they earn a bit more than their operating costs in income, not enough to pay the mortgage but the income often covers maintenance, utilities, taxes, and insurance.

As your property gets “seasoned on the third-party websites, e.g., Airbnb, it can demand higher rates. Sometime down the road, when there are repeat visitors, your earnings will increase to the point that just maybe it will pay the mortgage or generate higher net income.

Don’t forget to protect your investment property. Read this article which will take you step by step through the process.

Conclusion

The short-term vacation rental business is not dead. This is still a good investment vehicle for many. The most important thing is to spend some time analyzing the deal and considering some worst-case scenarios. A risk analysis should be the first thing any investor does for any property. Of course, a cash purchase will eliminate most of the potential risk until the short-term market recovers. The ROI on a cash investment may not be as good as a highly leveraged investment, but considering interest rates, all cash may be the best move.

You can finance the property using standard loans, e.g., conventional with 10-20% down, or go the commercial loan route. A key element in your analysis is the real income the property will generate. Forget what it did two years ago, what will it do in six months? Be realistic. Contact a property manager who specializes in short-term rentals and promises to use them if they help you work out the numbers.

There are few reliable sources on what the future will bring in this unsettled economy. Past performance can be used as long as it was pre-COVID. While it seems Airbnb is bulletproof, their forecasts for income will not relate to your potential. I see their income statements continue to reflect growth, but that is only because there are more vacation rentals on the market. That data is not reliable.

Contact a professional local property manager

If you want good options to invest, contact a local professional property manager and ask if any of their properties are going to be available for sale. Pick up a fully furnished and operating property that is managed by a property manager and you get a good history to start and the cost of the property will include the furnishings. Many are coming to the market as pre-foreclosures.

Tell the property manager what you are looking for and they can recommend to their clients there is a potential sale. The next step is to work with a local real estate agent. Don’t skip this part, the real estate agent can help provide valuable data for your research.

Want to see what properties are selling for today? Go to our home page and search. Even if you live in California, it may be nice to dream of moving to the Mississippi Gulf Coast. Go ahead, and take a good look at the property here. Click the button below to see for yourself.