Last updated on October 16th, 2024 at 01:28 pm

Last Updated on October 16, 2024 by

Your budget calculator and planner which Millennials need now are provided here for your use. It’s where everything financial starts. The actual Budget Calculator and Planner work when you combine them with the information provided on how to make effective use of them. Are you ready to create a strong financial future?

This article is part of a series starting with Millennials Are Buying Homes Near The Beach: Buy Yours Now. There are several tools throughout the series of articles starting with this one. You will learn in this article how much money you will have available to support a home loan to buy that new home. This article is number two in our series.

Millennials will buy more houses than any other generation. The first place to start your quest for a new house is to create a budget. Before you can use a home affordability calculator you need to know about your financial situation. This article will help you through the process with effective tools.

Our Millennial Budget Tool was designed to capture the total debt in detail that a typical Millennial may have. The first step is to open the calculator, save it to your computer and begin. (watch the instructional video).

Download the Millennial Budget Tool below by clicking on the “Download” button.

Starting with monthly expenses and specifically housing expenses, you will understand the nature of your total debt. This budget is intended to help you create an effective monthly budget to list all of your financial obligations along with daily living expenses. A general rule of thumb is to be sure that you list everything you can think of. Every dollar you expend should be listed somewhere in the budget even if it is in the “other” category.

Insert new tabs to help list out expenses that are consolidated into one line. For example, listing each credit card, the balance owed, and the monthly payment. Take the total from this section and enter it into the budget on the credit card line. Break down your budget to the smallest piece. If you do this, it will be easier to determine which to pay off first.

The next section is for household income. List your gross monthly income from all sources. Gross means before any deductions including taxes and 401k. Use area for side hustles that are not usually accounted for. While some of this income may not be exposed to a mortgage broker, you need to list it.

List income reported to the IRS separate from other income

If your income varies, use an average for the month. Be sure to list income that is reported to the IRS in the correct blocks.

Lots of people have income from sources where taxes are not deducted. Since this budget is for your eyes only, be truthful. If you receive $500 every birthday, include it in the total. If you earn money babysitting, have it. While the mortgage broker may tell you it can not be included to help pay your monthly mortgage payment, you know it helps with expenses.

Should you have a business, list only the profit from that business before taxes. Do not list anything you bought, losses, etc. Just the bottom line after paying all expenses.

After the income section comes the big number. is your spending positive or negative, meaning is your income going to support your current and future expenses?

Rent vs Buying using the Millennial Budget Calculator

First-time buyers applying for loans supported by Freddie Mac and Fammie Mae (quasi-government agencies) require a course in the home buying process. Some of what you would learn in that course on home budgeting is found in this article and others in our series.

One of the topics in the course is a comparative analysis of rent vs buying. You can determine the financial side of this by using our Millennial budget calculator and planner. Start with using the first column as either the house you want to buy or a rental. The second column will contain the other option. You will be able to see the difference in cost.

Of course, the cost is not the only decision point there are other important factors as well. And, often the house will be a better value for reasons other than the monthly payment. Learn more about what may go into this decision to buy vs rent in the other articles listed at the end of this article.

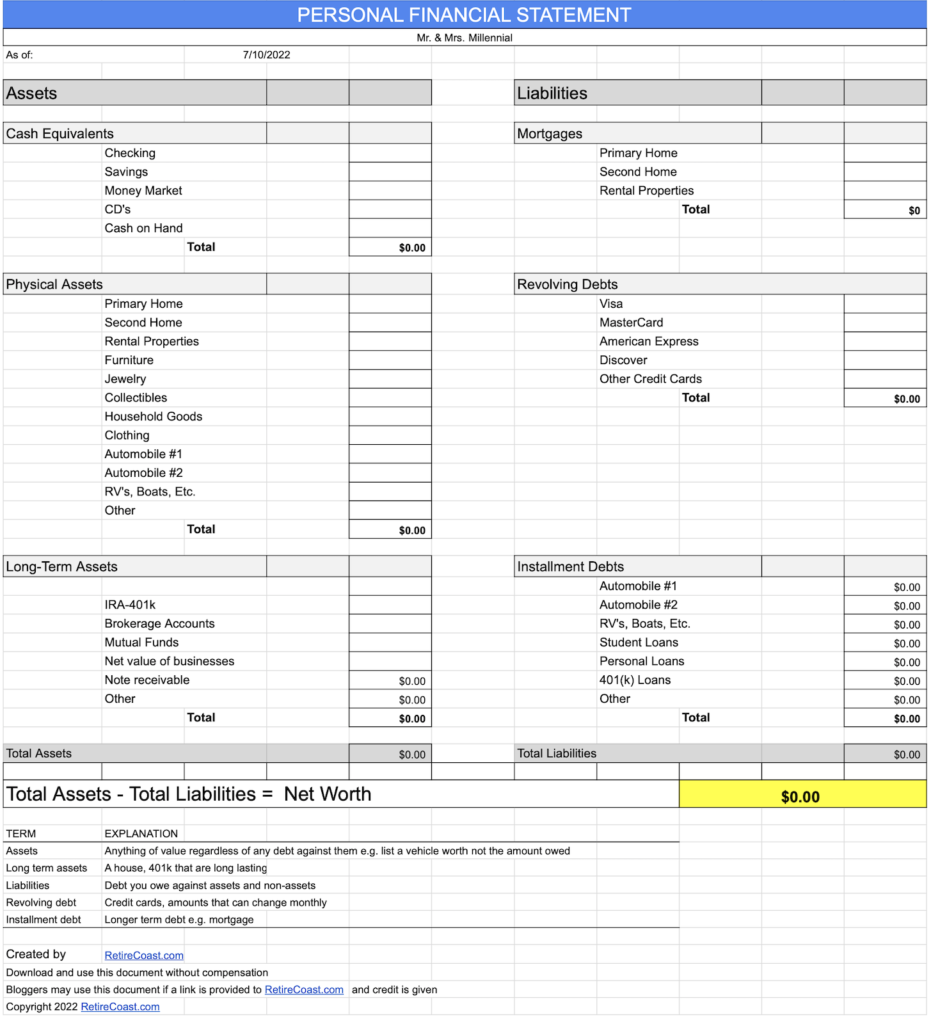

Personal Financial Statement

Aside from the budget, you should complete the Personal Financial Statement located on the next tab. This form will help you when you complete the mortgage loan application. Enter assets and liabilities. Liabilities are totals that you owe to creditors. The assets are things you own with their current market values.

I like to be conservative with my assets. If I can sell my car for $20,000, I will list it as $18,000. After you fill in this form you will be able to see your total net worth. This means if you sold all of the assets and paid off all of the debts, the Net Worth is what is left. You want to grow your net worth over time.

Check back monthly and adjust our debts, watch that net worth increase.

Eliminate one Latte per day

It’s a good idea to go back and make adjustments in the expenses section where you have the most control. Eliminate things you do not need e.g. that twice-daily Starbucks Latte. Try one latte per day. Reduce what you spend on clothing. Give up unhealthy habits e.g. smoking and reduce the number of beers you have after work.

Create a set of financial goals that you want to achieve e.g. save $5,000 by the end of the year. A good rule of thumb is to set a savings goal, something you can achieve. Since you can borrow from your 401k, perhaps you increase your contributions to that plan. Get those credit cards under control. Organize credit card payments to pay off the balances each month.

List the requirements for your savings down the road e.g. $10,000 for a down payment on a house. Detail the amount of money you will save and how you will save it. Set some goals to reduce monthly debts. Start by trying to get a lower interest rate on your credit cards with higher interest rates, those that you have a balance on.

Transfer the balances of your cards to one card with a 12-month grace period and then pay off that card.

Your car payments will be one of the last things you want to pay off because the interest rate is lower than for most credit cards. Your DTI ratio (debt-to-income) ratio should be a primary focus. Increase income and decrease debt. If you intend to buy a house, you want to get that ratio for all debt to below 45%.

Suggestions on how to reduce expenses

- Don’t pay late fees. Set your credit cards and recurring bills on a bill pay system. I suggest that you use your checking account bill pay system. Set the payment to be made on time every month. This will save you from fees and keep your credit in good shape.

- Don’t pay interest on credit cards. Pay off those cards each month to reduce the interest and eliminate fees

- Buy in bulk when it makes sense. Larger packages of paper goods at a big box store e.g. Sams or Costco. Check prices

- Look at expiration dates, and buy with the longest dates to avoid spoiled food and the expenses of replacement

- Don’t buy new when you can buy used e.g. clothing, tools, etc.

- Keep your cars in good repair. It costs more to have your car towed or repaired at the last minute

- Sell that motorcycle you do not need. You will save on insurance and registrations. Put the money in savings

- Stop offering to pay for everything with friends and family. Share all expenses

- Stop smoking. It can be done. Try a hypnotist

- Use the lowest octane gas in your car, it’s ok

- Cut back on paper towels. Use a dish towel and launder it

- Turn the AC/Heating to a more economical temperature that is still comfortable e.g. put on a sweater or open a window

- Delay upgrading your phone. The current phone will do for now. Do not be caught up in a contest about who has the latest.

- Cut the cord. No need for an expensive TV subscription. Use cable only and pay a small amount periodically for premium content. The library has the latest movies for free

- Start going to flea markets and buying items for your future house a few at a time. Store them for move-in day.

- Give up on going to expensive movies. Rent a Redbox and stay home with a pizza from the store.

- Go to high school sports games, fun and low cost

- Sell your car in 2022 for more than you paid for it and buy one at a lower cost.

Increasing your income:

And how about increasing your income

- Join the National Guard or Reserves. Extra income and great retirement. Keep your day job.

- Get a part-time job e.g. Uber

- Start an internet-based business

- Create a partnership e.g. LLC and start a business with someone that has similar goals

- Move to a lower-cost area and change jobs for a higher-paying one

- Take courses at Jr. College that will immediately add to your earning power

- Consider a career change

- If married or cohabitating, the other partner/spouse gets a job

- Rent a room in your house if possible and permitted

- Take online courses to improve your skills

This is your life, you must take charge of it. The fact that you are reading this article proves that you are taking the first steps to a wonderful future. The above lists are just a start. Discuss your plans with your significant other, a parent, or a mentor. Brainstorming is the best way to flush out the best ideas. Create a course and plan on how to get there.

Your budget is a giant step to taking charge of your financial life. Most people just coast. They have student loans and do not take action to deal with them. Some have car loans that they can not afford. Speaking of car loans, in 2022 used cars are worth far more than they were a couple of years ago.

If you need to get out of that high-cost loan, this is the time. Sell it for more than you paid for it and use the money to buy a lower-cost car. Unload that auto loan.

Build up the balances in your bank accounts. Invest the excess in something that is fairly safe but pays good interest. For example, Navy Federal Credit Union has a 3%+ starter CD for one year with a maximum of $3,000. Start with a few hundred and increase the amount to $3,000.

There may be another financial institution other than Navy Federal Credit Union out there where you can park some of your savings on a short-term basis until you qualify to buy a house.

The following are suggestions for using the budget tool:

The following are some suggestions for using the budget:

- Review the budget every month. Do it on payday

- Update all of the lines. E.g. reduce the amount on credit cards by the amount you paid down.

- Adjust any increased savings or changes in income

- If your goal is to submit a mortgage application soon, check your Debt-to-Income ratio, is it moving in the right direction

- Add any new expenses and reduce or eliminate expenses that you have paid off e.g. car loan

- Go to Credit Karma and check your credit history. See the note below about Credit Karma

- If you have a credit card that provides a credit score, check it each month for changes

- Work on fixing inaccurate credit issues e.g. loan was paid off months ago and shows a balance due.

- Are you on target to have sufficient funds available to buy your house?

- Is your credit on target to buy that house e.g. 720 score

- Keep funding that 401(k) plan the assets look good to lenders

Your budget will be your friend. It will become a joy to look at it each month and see improvement. The Budget Calculator and Planner: Millennials Need This Now will only work for you if you work with it.

A word about Credit Karma. This product is free and it is good to use when you know how to use it. The scores presented are not accurate for buying a house or for that matter almost anything. Lenders use a variety of scores and they rarely correlate with Credit Karmas. The positive thing is that the changes are almost as important. For example, if you have a score of 650 and the next month it goes to 670, that’s good.

While the 670 may not be accurate, the change is close to being accurate. That 20-point change is important. You can also look at your credit report which is almost always accurate at least to the point that the data may be a month old. Use the credit report to make sure there are no issues you need to fix. Keep in mind that you can’t fix something correct e.g. late payment.

There are some exceptions where a lender may be prevailed upon to make a one-time change. The reason for using Credit Karma is to achieve a higher credit score.

I hope that this article is helpful to you. This is one of a series of articles written specifically to assist Millennials to succeed in life. Many parents of Millennials did not have the skills to teach their children some of these life skills. Hopefully, this series of articles will help you. To get the most of them, please click on the other articles in the series that you have not yet read (some will be posted soon if you click and are returned here, come back soon when the article will be posted):

The foundation article is: Millennials Are Buying Homes Near The Beach: Buy Yours Now

Budget Calculator and planner: Millennials Need This Now – You need to know what these required programs mean for those putting less than 20% down. This article explains your choices and what each means to the cost of your new home.

23 easy ways Millennials can improve their credit scores: 2022 it’s time to get that credit score higher. This article goes into all things credit report and credit score to help you pay the lowest interest rate possible. Use our tools and learn how you can keep your score high and improve it if it’s low.

The Homeowner’s Insurance Puzzle Made Simple for Millennials 2022 You need this information to make informed decisions about your homeowner’s insurance policy. Without a policy, there is no mortgage. You can overpay for coverage that others will offer for a lower price. When should you claim for damage, theft, etc.?

Credit Cards – How to get the most out of credit cards and manage them to your benefit.

Mortgage Insurance – You need to know what these required programs mean for those putting less than 20% down. This article explains your choices and what each means to the cost of your new home.

The best mortgage loan guide for Millennials: Start now 2022– This article goes through an actual loan application so you can learn the process and how best to complete the form.

Millennials: How to find your first house in 2022 One of our longer articles goes through the entire process from locating a real estate agent to making the offer and the many steps that happen after the offer are accepted. Read this article after you have read all of the above articles because now you will be ready for the process.

This process takes from sixty to ninety days from the time you are ready to buy until you have the key. It’s an intense period that requires your complete attention and focuses on details. It’s also the most exciting part of the process. Finding that dream home may be a fast or slow process depending on a wide variety of factors discussed in this article.

We take you through each detail and show you most of the forms you will be required to sign during the process. Start working on those hand exercises, your signing hand is about to get busy.

Logan-Anderson Gulf Coastal Realtors is here to help you. If you are eventually looking for an affordable house in an affordable market, please go to our leading site LoganAndersonLLC.com where you can look at homes for sale. The Mississippi Gulf Coast is one of the most affordable home markets in the country. Read more about the area at RetireCoast.com

Note from the Author

I created the first version of this budget about 8 years ago. As part of my strategy to sell my company and stay on for a few years to help it through the transition, I wanted to plan for my exit. This Millennial Budget Calculator and Planner: Millennials need this now in a form much like the one included in this article that helped me through the transition. I realized that living in Southern California would drain my income with high taxes and all other costs.

The comparison part of the Millennial Budget Calculator and Planner: Millennials need this now allowed me to cast a wide net and consider moving to a more cost-effective place that was at the same time inviting and just a great place to live. I found such a place and compared all of the costs. The difference between the two areas was staggering. You can read about it by clicking here.

The point that I am making is this: It’s your life. You are not tied to any place either to work or live. Go where life is better and affordable.