Last updated on October 31st, 2024 at 02:25 pm

Last Updated on October 31, 2024 by

Millennials, this is the best mortgage loan guide for Millennials and you should start now in 2025 if you are ready. This article is not an advertisement for mortgage loans, it’s a helpful guide for you to understand how to obtain the best mortgage loan. This article will help you become well-prepared before you apply for your mortgage loan. Read further to find out how to get that loan. I bought my first home when I was 23 so you can do it as well.

Home prices have not been kind to millennial homebuyers recently. Low mortgage rates are on their way out even with great credit. Many young adults have less than stellar credit, perhaps you can relate. There are many steps in the home-buying process this article focuses on the mortgage loan.

This article will not dive into all aspects because we have written a whole series for the Millennial generation called Millennial Financial Resources Series. In the series, we break down the home buying process into bite-sized chunks for ease of understanding. This article is just one of those, you will find links to the others at the bottom of this article.

Three basic mortgage loan vendors

Unless you are one of the few Millennials with a credit score above 740, please pay attention here. There are three basic vendor types for mortgage loans.

- Banks – Citi, Bank of America, etc.

- Credit Unions – USAA, Navy Federal Credit Union, etc.

- Mortgage brokers – Online lenders, locally owned brokers

If you have one of those high scores, you can choose any of the above. If your credit score is above about 680, credit unions and banks may work with you. Try a mortgage broker if your score is below 680. The fact that you have a checking account with a bank but have a low score does not mean you will receive any benefits from your bank. Your relationship with the bank usually has nothing to do with applying for a mortgage loan.

Most of the above will not retain the mortgage that they originate. Before the ink is dry on the contract, some of the above will have sold your mortgage to a mortgage servicer company. None of this has any bearing on your ability to secure a mortgage loan but you should know what happens after closing.

A Mortgage broker is usually the best choice for most Millennials. Banks and credit unions have one source for funding and that is their institution. They may have some variations e.g. 30 years fixed and a 15-year fixed mortgage. This is not the same thing as having multiple sources of cash.

You will work with the mortgage originator or loan officer

The mortgage broker has a front person called a loan officer or “originator”. This person usually works on a commission basis. The good thing is that they will try their best to help you get that loan. What differentiates a mortgage broker from a bank or credit union is that they have multiple sources of funds. This is very important because each actual lender has its parameters. Some may say that a 600 score is good and they will accept an income-to-credit ratio of up to 50%.

Perhaps you have been on the job for one year and lender A requires two years but lender B requires only one year. The mortgage broker has the flexibility to find the right lender for you.

I want to make it clear that banks and credit unions are good places to obtain a mortgage loan. I have used both many times over many years. As your score improves so do choices for loans. For the lender, it’s all about risk. That credit report is extremely important. First-time homebuyers often feel like they are aliens in this fast-paced home purchase environment. Back to that loan officer.

Find a loan officer that you like and who you can trust. As with all professions, there are good ones, fair ones, and well those you would prefer to avoid. Before you approach a loan officer be ready. The harder you work before first contact with a loan officer, the better the result. I will describe more about the loan process in the next few paragraphs. Please read our article about your credit report (click the link at the end). Understanding your credit report and score is critical to the mortgage application process.

Two basic types of mortgage loan programs

Let’s discuss typical loan programs offered by financial institutions. There are two types of loans:

- Conventional Loans

- Loans guaranteed by a government agency (Freddie Mac & Fannie Mae)

Lenders with their own resources offer conventional loans. In other words, not backed by the federal government. These loans have fewer restrictions on several aspects of the buying process. Conventional mortgages with down payments of less than 20% will require mortgage insurance.

Loans backed by a government agency and administered by the FHA (Federal Housing Administration) offer low down payment options. If you put down less than 20% of the purchase price the lender will add a mortgage insurance premium to your loan.

Why should I care what type of loan I apply for? Why the two different programs?

People with good credit usually use conventional mortgage loans not always but often. Many people put 20% down on their homes to lower the monthly payment and avoid the mortgage insurance mentioned above. If you have a solid income and a good credit report and a higher score, a conventional loan may be the way to go.

The best mortgage loan guide for Millennials: start now 2022, and keep on reading

Low down payment options, FHA

Many millennials do not have great credit or a high score or a big down payment. First-time buyers want to get that house with the least amount out of pocket. This is where your mortgage broker working through your new best friend, the loan officer can help you. Yes, banks and credit unions may be able to offer FHA loans but mortgage brokers live and breathe these loans.

A typical FHA or government-backed loan will ask you to put down 3.5% of the purchase price plus you must come up with closing costs. I will get into this shortly. Back to that low-down payment. Understand that while a 3.5% downpayment is a good thing if you are a bit short on cash, it will come with a monthly payment that is higher than a traditional 20% down payment.

To help the government gain some security on these low-interest loans, they charge a one-time up-front fee for their mortgage insurance premium and a fee each month included in our total payment. Mortgage insurance premiums are for the lender in the event you default. There are zero benefits for you directly.

You need as little as 3.5% down to buy

Unless you know that you have sufficient cash to make a 20% down payment, you will probably be looking at an FHA loan. If you live in one of the rural areas where USDA loans are available, perhaps a zero-down USDA loan may work for you. As I mentioned, you may be able to squeeze into a house with little cash but these mortgage programs will require that you can afford to make the payment.

One very good reason to work with a mortgage broker is that the mortgage broker will look at all of your documentation and put the puzzle together for you. Your loan officer will fit you into a program that will get you approved. Remember, they work on a commission and will not waste your time or theirs. You will find out almost immediately after your first discussion if it’s time for you to buy your first home.

We are walking through the mortgage loan process and there is more, however, it’s time to pause for a bit to discuss what you need to accomplish before you apply for a loan.

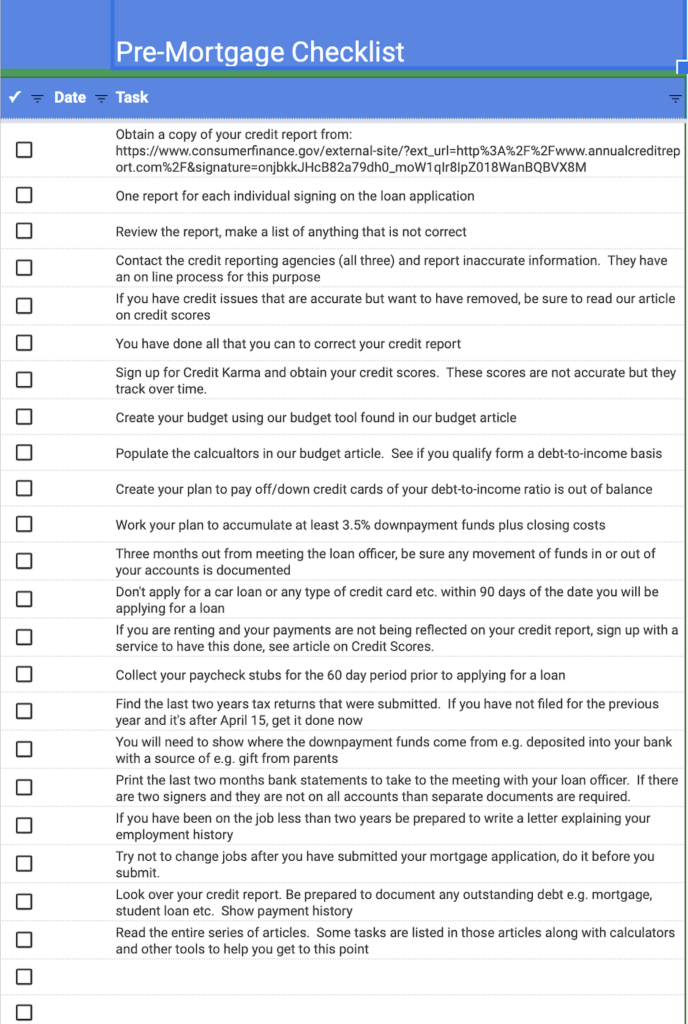

Use our checklist (download it) to be sure that you are ready to apply for a mortgage. Every time you make an application, your credit score takes a hit. A checklist will help you get approved the first time you try. Our checklist for your new home loan requires that you give some serious thought to several items including how much money you have for a down payment.

Your credit history and monthly income are key factors on the checklist. They will determine if you can get a loan and how much home you can afford to buy. Hopefully, you have started this process many months before you are ready to submit the loan documents. Our article (bottom of page) on credit scores and credit cards will help you understand that part of the mortgage application process.

Nearly half of Millennials own homes, you need to be part of the other half.

The average age in 2022 for a first time buyer is 33

I bought my first home when I was 23. Age is not a factor when you have excellent credit a good job and your debt-to-income ratio is in line with the expected monthly payment. No need to wait until you are 33 to buy your first house.

The actual mortgage loan application process explained

Shopping for the right loan broker and loan

There are various ways you can locate a good loan officer. The best is to ask a real estate agent. You can ask friends and relatives who have recently had a good experience with a loan officer. Interest rates are similar among lenders, money is a commodity and competition usually keeps rates in line with various lenders.

The difference between loan officers usually comes down not to rates but to their personality and ability to make you feel comfortable. A good loan officer should not attempt to sell you a loan that even if approved pushes too hard on your ability to make that monthly payment. Loan officers are not credit counselors. Loan officers know how to get loans approved. They want that refinance down the road or a new loan.

When shopping for a lender, be sure that you ask for their loan costs. You are looking for the costs that the lender charges, not the escrow or attorney. These costs can include “points” or lender fees. Document fees and other items, some of which may not be something you want to pay.

Compare loans

Compare those costs to other lenders’ costs for the same terms and conditions. Zero-cost loans are available. Ask where the costs went. Usually into the interest rate so compare. These are acceptable practices but you must compare this type of approach to one with fees and a lower interest rate.

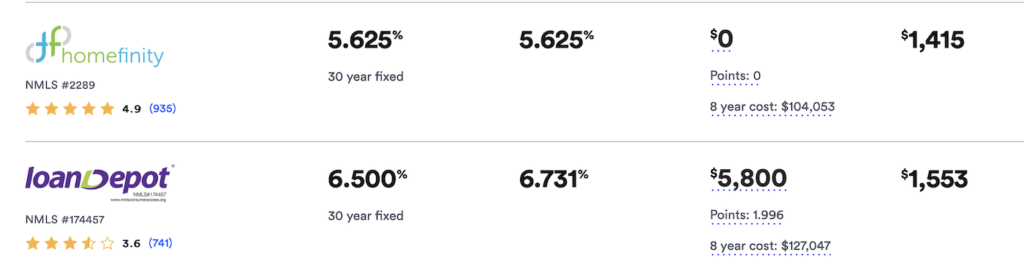

Look at the chart below. There are two loans from two lenders. One is offering a zero-dollar point cost program at 5.625% interest. Compare this to the loan with $5,800 in points cost. It looks like the one with zero points is the best.

The first lender may add costs to the loan that the second lender does not. This is what you need to do when discussing with your selected lender the details of the loan:

- How many are the points? Both percent of the amount financed and the dollar amount?

- If there are no points, how did they arrive at that, and load the costs into the interest rate?

- What are all of the costs for the loan, get a list and ask for an explanation of all items on the list

- Don’t confuse the lender’s cost with other costs such as title insurance the lender costs are often:

- Mortgage broker fee – typical (when zero points this may be where they recover their costs)

- Origination fee (points)- typical

- Document fees (why?)

- Other fees (explain)

Mortgage Loan options

Your loan officer may offer you the opportunity to pay down the interest rate. For example, the rate is 6% and you can reduce that to 5.5% if you pay more points. Some people do this to qualify when their debt-to-income ratio is close. The lower interest rate will lower the monthly payment.

Unless you are having problems qualifying, you could be defeating the purpose of obtaining a low-down payment house by putting more into the interest rate. Consider this. You are buying your forever home right? Not. On average, buyers sell their homes within five years. Regardless of your current plans, life happens and you may sell.

If you paid down that mortgage you will not get that money back. Also, if interest rates go down in later years you can refinance and lower your payment. Just consider the outcome before you jump and say yes.

When you believe you are ready to contact a loan officer and make an application for a mortgage loan these are the steps you will take:

- Arrange to meet in person with the loan officer (online is ok but not as personal)

- Bring the following documents with you:

- Completed mortgage loan application

- Personal financial statement

- Two months’ paycheck stubs or printouts showing all details

- Two months’ bank account statements showing paycheck deposits

- Two years filed tax returns (last two years if the current year is not filed)

- Print your Income-to-debt ratio results

- Your most recent credit report (ok if from Credit Karma) make sure it’s complete

- Documents that show where your downpayment and closing costs are located (or a letter from your parents for example stating they will GIFT you the funds.

- Copies of all investment account statements e.g. 401k

- Be prepared to discuss each of the documents above

- Warning, you can not borrow any funds for your downpayment or closing costs. You can receive a gift but it must be clear that it is not to be paid back.

- Tell the loan officer the estimated price you will be paying for a house (using data from the tools found in the “23 Easy Ways Millennials can improve their credit scores:2025”, “Budget Calculator and Planner: Millennials Need this Now” articles (links are listed below).

- Explain the source of your downpayment and closing cost funds

- Tell the loan officer the amount you are comfortable paying each month for your principal and interest payment

- Explain that you may be interested in the FHA 3.5% down the program or the USDA zero down payment program (assuming you are).

- Ask the loan officer to show you the various programs with their interest rates and costs. Costs are important.

The mortgage loan application

The mortgage loan application form “Uniform Residential Loan Application” may be presented to you to fill in by hand or the lender may ask the questions. They like to enter the data to avoid mistakes made when handwriting. You will probably not see the completed document until you are approved and ready to sign documents.

You will be signing the document that they created. Sometimes I find errors in their document but do not attempt to correct them if they are minor. The information in that final document was presented to the underwriter for approval. You should click the download button and save this to your computer to print.

If you click on the application below it will move so you can see what information you must gather. Don’t fill in the top of the form regarding an actual property until you get to that point and you are not there yet. If you have completed the budget and financial statement documents found in our articles, you can copy the information over to this form. Present this form to your loan officer with the other documents we have described above.

Tip

If this is a joint application, that is, two or more persons who will be signing on the application and the mortgage loan, consolidate all income for section V. You may have separate rents now, for example, consolidate them for this form. Also, do not list debts that are not listed on your credit report. Lenders want to see clean applications.

If you have a debt not showing on your credit report, the lender may ask for documentation that you may not have or want to provide e.g. loan from your parents. The lender will check your credit go through this application and check off what they see on the credit report. The information from both sources must match.

Next steps in the process

Now that you have completed all of your homework listed in the first part of this article and you have shopped for and met a loan officer, it’s time for the next phase in the Mortgage Loan Process. I hope you think at this point that this is the best mortgage loan guide for Millennials: start now 2025

The pre-approval letter

Your loan officer will take your Social Security number from your forms and run a credit check. This is very basic, they are looking for your credit score and some basic information such as bad debts, foreclosures, etc. Having found nothing of great concern, you will receive a pre-approval letter.

If there are major issues, you may be told that they can not approve you at this time but, if you do x y, and z, you can come back and try again. Hopefully, you have read our entire series of articles, used the tools provided, gathered all of the data, and met with the loan officer.

You will know going through our process if you qualify or not. For example, if you can not make the debt-to-income work out based on what you want to buy, don’t bother going to the loan officer until you determine how to get the debt-to-income lined up. Our article on this topic will help you.

Now it’s time to find a Real Estate Agent

WITH THE PRE-APPROVAL LETTER IN HAND, YOU CAN FIND A REAL ESTATE AGENT WHO WILL HELP YOU FIND A HOUSE. WHEN YOU HAVE LOCATED THE HOUSE YOU WANT AND RECEIVE A SIGNED OFFER, THE ITEMS DISCUSSED BELOW WILL FALL INTO PLACE

You are approved

Ok, so you are approved. This is a conditional approval as your letter will state. Great you passed the first stage. Now for the serious stuff. The loan documents will be assigned to the “underwriter”. This individual has one goal: To prove you are a bad risk. This sounds cynical but it’s true. The underwriter is the guardian of the money at a lender firm.

This person must review all documents, and credit reports, call employers, and dig, dig, dig for dirt on you. Finding none, you will be approved for the loan and go to closing. Not so fast, there is a process even when you are looking like a golden client.

Most borrowers have some issues with their credit reports or in the research. A great example is a deposit into your checking account two months ago for $5,000. That’s a red flag, it’s unusual behavior and not reflected in your investment statements or employer paycheck stubs. Everything stops now. That file moves from the active desk to the research file.

That dreaded loose end

You got caught depositing $5,000 into your checking account and you must explain it by written letter. As you know $5,000 was a “gift” from your parents to help you pay for closing costs. Since this is acceptable, you write a letter and explain that your parents (name) “gave” you funds from your childhood trust left by your grandparents. The letter goes to the loan officer.

The underwriter has to pull the file back to the active file and determine if they believe you. A person may want a letter from your parents. During this process, your loan is on hold yet the clock is ticking on the closing date. Ok, it’s time to panic now.

Several days or even a week later you may or may not be told that this contingency is cleared and the loan is moving forward. Just as you think everything is ok, the lender finds a misspelling of your name on a credit report. This generates another letter from you and an attempt with the credit reporting agency to correct it.

Finally, you are fully approved

If you are lucky, you will be told about a week before the date set to close on your house that you have been fully approved for the loan. But wait! The underwriter does not trust you so he/she will be running a last-minute credit report just a day or two before closing.

You could not wait to buy that car so you thought after receiving notice of final credit approval, you apply for an auto loan. The underwriter picks it up on the last-minute credit report. Your loan just died. If you think this does not happen, I can tell you as a fact that it does. All of the advice that was given before and during the process was ignored and the underwriter disapproved the loan for one key reason, our debt-to-income ratio was kicked off.

Oh, one other reason why the loan was dead on arrival, you were being dumb. I think that being dumb is one of the reasons the underwriters give for terminating a loan guarantee.

Ok, good thing we were talking about someone else here, you did not buy anything or change your credit. Three days before closing you will receive what is called a “CD” or “Clear to Close”. This is the signal to the closing escrow/attorneys that they can calculate the final cash-to-the-table requirement.

You will receive from the local loan processor e.g. escrow or attorney the amount you need to bring to the closing table. This is based on calculations from the CD. You should wire the funds or check with the closer and determine if a bank check will do.

The loan process summarized

The following is a list of the mortgage loan process leaving out the home-buying process which is covered in another article listed below:

- Read our entire series of Millennial Financial Resources, there are valuable tools you will need

- Once you have read our series Millennial Financial Resources, and gathered documents listed in this and other articles

- Research a loan broker, make contact, and set a meeting

- Present all of the documents listed above

- Fix any issues from the discussion

- Obtain a pre-approval letter

- Contact a real estate agent, make an offer and send the completed contract to the loan officer

- Stay in contact with the loan officer and be prepared to provide more documentation and respond with letters.

- Do not do anything from the start to the ink drying on the final documents that could cause your approval to be terminated. No applications for credit, do not change jobs.

- Go to closing, get your keys, and enjoy your new home

I hope that this article is helpful to you. This is one of a series of articles written specifically to assist Millennials to succeed in life. Many parents of Millennials did not have the skills to teach their children some of these life skills. Hopefully, this series of articles will help you. To get the most of them, please click on the other articles in the series that you have not yet read (some will be posted soon if you click and are returned here, come back soon when the article will be posted):

The foundation article is: Millennials Are Buying Homes Near The Beach: Buy Yours Now

Budget Calculator and planner: Millennials Need This Now – You need to know what these required programs mean for those putting less than 20% down. This article explains your choices and what each means to the cost of your new home.

23 easy ways Millennials can improve their credit scores: 2022 it’s time to get that credit score higher. This article goes into all things credit report and credit score to help you pay the lowest interest rate possible. Use our tools and learn how you can keep your score high and improve it if it’s low.

The Homeowner’s Insurance Puzzle Made Simple for Millennials 2022 You need this information to make informed decisions about your homeowner’s insurance policy. Without a policy, there is no mortgage. You can overpay for coverage that others will offer for a lower price. When should you claim for damage, theft, etc.?

Credit Cards – How to get the most out of credit cards and manage them to your benefit.

Mortgage Insurance – You need to know what these required programs mean for those putting less than 20% down. This article explains your choices and what each means to the cost of your new home.

The best mortgage loan guide for Millennials: Start now 2022– This article goes through an actual loan application so you can learn the process and how best to complete the form.

Millennials: How to find your first house in 2022 One of our longer articles goes through the entire process from locating a real estate agent to making the offer and the many steps that happen after the offer is accepted. Read this article after you have read all of the above articles because now you will be ready for the process.

This process takes from sixty to ninety days from the time you are ready to buy until you have the key. It’s an intense period that requires your complete attention and focus on details. It’s also the most exciting part of the process. Finding that dream home may be a fast or slow process depending on a wide variety of factors discussed in this article.

We take you through each detail and show you most of the forms you will be required to sign during the process. Start working on those hand exercises, your signing hand is about to get busy.

Logan-Anderson Gulf Coastal Realtors is here to help you. If you are eventually looking for an affordable house in an affordable market, please go to our leading site LoganAndersonLLC.com where you can look at homes for sale. The Mississippi Gulf Coast is one of the most affordable home markets in the country. Read more about the area at RetireCoast.com