Last updated on November 4th, 2022 at 09:38 pm

Last Updated on November 4, 2022 by

Are you a Millennial? Is your credit score lower than 780? If you answered yes to both questions, you need the information contained in the 23 easy ways Millennials can improve their credit scores:2023. This list is a great start along with explanations on how to implement the 23 tips. Millennials who were off to a rocky start with their credit can get it fixed and enjoy the many benefits that come from excellent credit.

This is the third article in our series “Millennial Financial Resources”. The goal of 23 easy ways Millennials can improve their credit scores:2023 and the other articles in our series is to help improve financial literacy. Many Millennials came of age just after the housing crisis of 2009 providing them with a difficult start to adulthood. We want to change all of that with our modest effort at financial education.

After you read through the list below, read the following suggestions for implementing many of the items on the list. Then click on the other articles in our series listed at the bottom of this article. Please sign up below to receive notices of future articles. We love comments as well.

23 easy ways you can improve your credit scores

- Check your credit report by ordering the free credit report. Look at every item, and make a list of incorrect information.

- Contact the credit bureau and correct any errors on your report

- List late payments – Write every vendor where you have only one late payment in the past 12 months (use sample letter)

- If you are a renter and not being reported to credit agencies, sign up here to have this done

- Obtain a credit card if you do not have one (see here for instructions)

- Pay down all credit card balances to 10% or less and calculate your credit utilization ratio

- Use bills from your checking account to auto-pay credit cards and other expenses (not the creditor’s system)

- Don’t close any old credit cards or any credit cards for that matter. Closing can damage your credit.

- If you have high-interest rate cards with significant balances, obtain a personal loan and pay them off at a lower interest rate. Be careful of consolidation offers from card issuers there may be negative provisions e.g. if you charge anything you will pay interest on it and payments against the original draw will only be applied after the new charge balance is fully paid.

- Ask a parent or sibling to add you to a credit card account that has been paid on time and has a high total credit limit. You must be added to the actual account with SSN. Tell the parent or sibling you will not use the card.

- Pay every bill on time every time. One late will stay with you for years.

- Check your mix of credit, installment loans, credit cards, home loan

- Parking tickets and outstanding court citations must be paid. If they go to collection agencies they will appear on credit bureaus

- Ask financial institutions to remove any joint account responsibilities for credit where a co-signer is not paying their part of the bill

- If you have an unpaid debt on your credit report, negotiate with the owner of the debt to remove it in exchange for X. Get it in writing

- Open a Credit Karma account (free). The scores are not accurate but the changes each month are a good indicator of performance

- Some major credit cards provide a credit score each month. Review this score it will be more accurate than other sources

- When your score rises above 690, apply for one or two high-limit credit cards within 30 days of each other. Do this twice per year until you have $100,000 in available credit (only if you can manage your credit well and not carry balances)

- Pay off all credit cards each month in full.

- Assign one recurring bill to each credit card to keep them active. For example, Netflix. You should have set up the card on your bill pay.

- Use your budget calculator and planner to be sure your debts are being paid off (see our article below)

- Correct late rental payments at the source, the landlord.

- Sign up to have your on-time rent payments reported each month to the credit reporting agencies

- Fix issues with student loans e.g. refinance make payments on time

What is a Credit Score

A credit score is usually called a FICO score. Created by the Fair Issac Corporation and used by over 90% of lenders in the U.S. This score is created from data gathered by three major credit reporting companies. Experian, TransUnion, and Equifax. If you apply for credit to buy a car, for example, only one credit reporting agency will likely be involved e.g. Experian. If you buy a house, all three will be used and the scores averaged.

When a creditor receives a request to check credit through credit applications hard inquiries are generated. A hard inquiry remains on your report for two years. This hard inquiry will result in a report for the creditor who will use it to evaluate if you will receive a loan. A score will be created at that time. That score is one of many types of scores that creditors use.

If you are shopping for a new credit card, it’s a good idea to apply at two or three at the same time. This will lower the value of the hard inquiries as reporting bureaus know you are shopping around. Do this within a 30-day window. If you would like more in-depth information about the credit scoring system, click here to visit the FICO website where educational information exists. You can also subscribe to FICO to obtain your credit scores.

23 Easy ways Millennials can improve their credit scores

JUST A START, BUT THE KEY ELEMENT THAT IS NOT LISTED HERE IS YOU! ARE YOU SERIOUS ABOUT IMPROVING YOUR CREDIT SCORE? IT’S A DIFFICULT THING TO DO, IT TAKES TIME AND FOCUS. IF YOU CAN DO IT, YOU CAN SAVE INCREDIBLE AMOUNTS OF MONEY OVER TIME IN LOWER INTEREST RATES.

Elements of the Credit Score

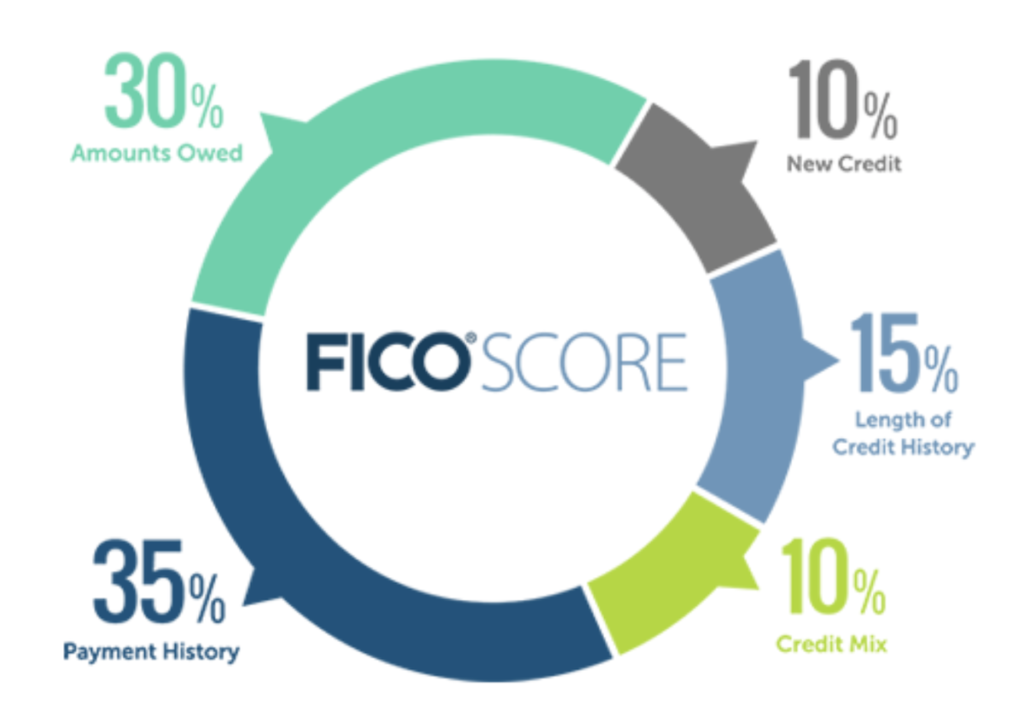

The national average FICO score for Millennials is about 650 which is considered “fair”. Gen Xers are just behind and baby boomers have scores in the good range. Part of what makes up a score is the length of time for your total credit or credit history. Boomers have lived longer and it’s easier for them to meet this criterion which equals about 15% of the score.

Millennials can get there if they obtain credit early and maintain a good payment history. The most important thing is to make payments on time every time. Good credit habits can insure that the 35% of major credit bureaus give on-time payments are yours for the taking. Most people with a poor credit score have missed payments.

A good credit mix consists of having various types of accounts such as auto loans, personal loans, mortgage loans, and credit cards. This is worth 10% of the total score.

Credit utilization is a big factor

Finally, the credit utilization rate earns up to 30% credit. This means that while you have credit, you can’t use it. This is an oxymoron but true. If you use much more than 10% of the total available credit shown on your report, your score will take a hit. This limit ratio is a big deal. I recommend that my clients add credit cards over time to increase the credit available.

If you have for example $50,000 in available credit you can use up to $5,000 at any one time. Using more can make a significant impact on your score.

Some people throw around 20%, 30%, and other numbers. When you have a high score e.g. 780 you can afford a hit if you owe 30%. A 680 score can be far more impacted and result in lower scores. You should know that I am not talking about the balance on your card. When the bureaus check and find a higher utilization, they do not ask you if you intend to pay it off at the end of the month. The credit reporting agencies look at that one day.

Your bank account

A word about your bank account. Bounced checks and overdrawn accounts will not appear on your credit report. The but here banks will report uncollected debt such as bank fees and penalties not paid from these overdrawn accounts. Your bank will make numerous attempts to contact you before they take any action.

As mentioned above, you should put your utility bills on autopay. Many will permit you to have them charged to a credit card. You can then pay off the credit card. Avoid being late, utility companies do report to credit agencies.

The student loan dilemma

There is no quick fix for student loans. They will take a while to pay off. You can refinance them over and over to reduce the interest rate. Be careful about extending the period, this will cost you more. Don’t mortgage the future by letting this debt hang around.

I found an excellent article written on BuzzFeed which you can access by clicking here. Basically, the author asked their BuzzFeed community to comment on how they paid off their student loans. There are some great stories, perhaps one of the stories will help you deal with your student loans.

Most of the responses mentioned the sacrifice of the now for a great future. For a generation who has had almost everything they wanted, it’s interesting how these individuals adjusted to life as independent adults and took charge of their financial situations.

Are you a renter?

If an eviction shows up on your credit report, confront the landlord with a plan to repay any losses and have them remove the item from the credit bureaus. The best way is to offer an apology and a one-time payment or series of payments culminating in their written promise to remove the item. You should meet in person if possible.

An important thing that a renter can do to help gain excellent credit is to sign up with a service that will report your on-time rent payments. This will help when you buy a house. The link below to Rent Reporters will help you establish great credit by just paying your rent on time.

Clearing negative items from your credit reports

Dealing with late payments on your credit bureaus is not the easiest of tasks. A great way to handle this is to create a spreadsheet if you have several accounts with late charges. Before you start keep in mind that if you owe money it is not likely they will remove the item without payment of some amount.

Send our letter template to creditors

Gather the names and mailing addresses of the card issuers and others with whom you owe the debt. We have created two letters for you to download and use with Microsoft Word. Just fill in the blanks by removing the lines. Handwrite the envelopes with legible print. Put a stamp on it and mail it.

Record the letter in your spreadsheet. The date you sent it and to whom. Keep an electronic copy and a paper copy. Wait three weeks. If you do not have an answer by email, phone, or snail mail, send the second letter and mark it “Second Letter” near the top. You will need to attach a copy of the first to the back of the second letter. Mail again and record the information.

The good news is that the company that you mailed the letters to should respond to the first about the time they receive the second. They will know you are serious. You must follow up on any promise to remove the negative information. Use Credit Karma it’s free. Should they refuse, file it away and try again in six months.

Send a second letter

The second letter is for use with a collection agency. Send the letter and wait for the reply. If there is an opening in the letter follow through. If it seems difficult to work with the letter, call them and make a deal.

Set your goals to achieve a higher credit score by working diligently at all of the tasks listed above. You will never get a good credit score by accident. It takes time and effort to achieve a great score and continuous work to keep it. You must be tenacious, and keep the pressure on. Send several letters if that is what it takes.

Use the link above from CreditRepair.com if you need help. They have programs to help people with multiple issues or that do not have time to pursue this on their own. Years ago, I helped friends by doing what CredirReport is doing. It was time-consuming and time-sensitive. Don’t start the process unless you can follow through.

There are some potential consequences to trying to fix credit on your own. Sometimes the entry on the report is in error. It may indicate one late item when you know for a fact there were more. By asking the creditor to remove the one item on file, their computer could discover the others and repost them. I have seen this.

There is so much more to pass along to you that it’s not possible to do it in a single article. This article, 23 Easy ways Millennials can improve their credit scores is just one of our series of Millennial Financial Resources. Please check below for more resources.

I hope that this article is helpful to you. This is one of a series of articles written specifically to assist Millennials to succeed in life. Many parents of Millennials did not have the skills to teach their children some of these life skills. Hopefully, this series of articles will help you. To get the most of them, please click on the other articles in the series that you have not yet read (some will be posted soon if you click and are returned here, come back soon when the article will be posted):

The foundation article is: Millennials Are Buying Homes Near The Beach: Buy Yours Now

Budget Calculator and planner: Millennials Need This Now – You need to know what these required programs mean for those putting less than 20% down. This article explains your choices and what each means to the cost of your new home.

23 easy ways Millennials can improve their credit scores: 2022 it’s time to get that credit score higher. This article goes into all things credit report and credit score to help you pay the lowest interest rate possible. Use our tools and learn how you can keep your score high and improve it if it’s low.

The Homeowner’s Insurance Puzzle Made Simple for Millennials 2022 You need this information to make informed decisions about your homeowner’s insurance policy. Without a policy, there is no mortgage. You can overpay for coverage that others will offer for a lower price. When should you claim for damage, theft, etc.?

Credit Cards – How to get the most out of credit cards and manage them to your benefit.

Mortgage Insurance – You need to know what these required programs mean for those putting less than 20% down. This article explains your choices and what each means to the cost of your new home.

The best mortgage loan guide for Millennials: Start now 2022– This article goes through an actual loan application so you can learn the process and how best to complete the form.

Millennials: How to find your first house in 2022 One of our longer articles goes through the entire process from locating a real estate agent to making the offer and the many steps that happen after the offer is accepted. Read this article after you have read all of the above articles because now you will be ready for the process.

This process takes from sixty to ninety days from the time you are ready to buy until you have the key. It’s an intense period that requires your complete attention and focuses on details. It’s also the most exciting part of the process. Finding that dream home may be a fast or slow process depending on a wide variety of factors discussed in this article.

We take you through each detail and show you most of the forms you will be required to sign during the process. Start working on those hand exercises, your signing hand is about to get busy.

Logan-Anderson Gulf Coastal Realtors is here to help you. If you are eventually looking for an affordable house in an affordable market, please go to our leading site LoganAndersonLLC.com where you can look at homes for sale. The Mississippi Gulf Coast is one of the most affordable home markets in the country. Read more about the area at RetireCoast.com

23 Easy ways Millennials can improve their credit scores are covered by copyright laws of the United States. Readers may use all resources contained as long as it is not for direct income and credit and links are given as appropriate

Register below to be notified of new blog articles.

We will not sell or give your email to any non-related entity, promise.

This article contains some links to sites that may compensate Logan Anderson, Gulf Coastal Realtors. We have included these vendors because the services they offer may be of significant benefit to our readers.